Wealth is the slave of a wise man and the master of a fool — Seneca

Finance becomes an obsession.

Not because of the money but because of the possibilities it opens up. When you figure out money you figure out much of life. You figure out how to create value and that feeling is the best in the world.

I began studying finance more than a decade ago in the front seat of my aunty’s beaten-up old GM Astra.

I’d park behind a well-known Melbourne casino (how ironic) and read every book I could about money. I’d take notes religiously. Over time I found the same common concepts were present in every book I read.

Still to this day I study finance daily. According to my rough calculations, I’ve spent more than 16,733 hours doing this.

Here are the most important money rules from my studies.

A poor work ethic won’t lead to wealth

Hard work is overrated.

Trading time for money is a loser’s game as they say. But all financial freedom journeys begin with hard work.

That’s the taboo reality most gurus ignore. They act like everyone can have s*x on the beach after buying their first stock or investment property.

It’s just not true.

Wealth starts out as hard work while you turn active income into passive income. As passive income takes over from active income, life does get easier but that takes patience most don’t have.

Work ethic matters.

It doesn’t mean you grind until 3 AM, although it does mean you’re not afraid of a hard day’s work. I’ve made 7 figures online and I can tell you I’ve worked hard for it. It’s one of the achievements I’m proud of.

Don’t be fooled into thinking hard work doesn’t matter.

The most obvious money rule 99% of people forget

Rule: make more than you spend.

I feel like a fraud for including this one. Everyone knows this, right? Wrong. I’ve learned the most important money rules are the most obvious and the ones people break the most.

Money comes in, money goes out. If more money goes out than comes in, then you’ll never be wealthy. I don’t say that to be an ass, it’s just the truth. It’s the law of the universe. It’s what grade one math class teaches you.

Like all rules, it’s easier said than done. Making sure your bank account isn’t hemorrhaging money is hard. Every business wants to get into your back pocket and empty your wallet. That’s their job.

That’s capitalism baby!

I ain’t mad at it. It is what it is. Just be aware of this simple financial equation. Find ways to have more money hit your bank account than goes out.

The interest on a home mortgage costs more than the debt

It’s common to borrow money to buy a home.

We can’t do what our grandparents did anymore and save up so we can pay $10,000 for a 5 bedroom home in the suburbs. We need a mortgage. Mortgages require you to pay interest. Few people ever calculate the cost of that interest or understand how much of an expense it is.

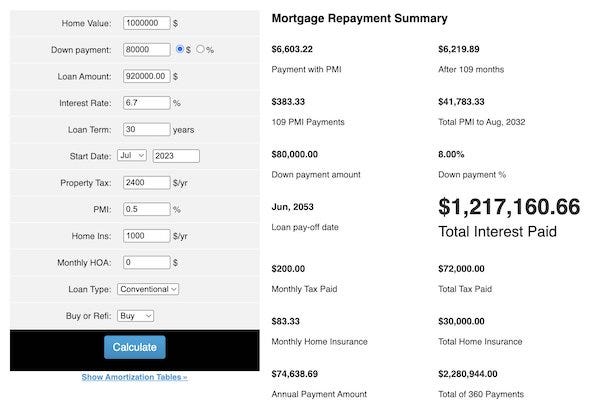

Money blogger LevelsIO says if you borrow $1,000,000 you pay $2,217,160 in interest. Ouch!

Image credit-LevelsIO via this post

Rule: interest on debt is the second biggest expense after taxes.

“When nothing is working (financially), explore and make a lot of small bets”

Not all of you are blessed with money.

Perhaps your savings are depleted or you own no assets. What does someone in that position do? They try to find a new income stream or way of making money that works.

This requires a series of small bets. Each one is designed to be an experiment to lead you down a new financial path. No guru can tell you what path.

We each find our financial freedom through exploration.

What we don’t want to do is run out into the street and throw money or time at some big new goal without first having the data to back it up.

If money is a problem it’s time to explore.

Rule: more money comes from new income streams. When you find the right one then double down until it stops working. Then rinse and repeat.

Budgeting and reducing expenses doesn’t make you wealthy

This is common advice peddled in Dave Ramsay-style books.

It’s the worst advice ever. Those who teach this fake rule have the employee mindset. They come from a place of scarcity. They protect their money like they protect their mother. So they miss all the opportunities.

And they focus on the wrong thing.

Wealthy people focus on how to make more money. If you get laid off you don’t get back on your feet by cutting expenses and worrying about money.

What fixes the problem is more money. New money.

It’s so simple and yet I meet so many people who do not understand this universal law. If money is a problem it means you’re not creating enough value. The good news is your skills create value.

So if money is an issue you can upgrade or add new skills to fix the problem. That generates more money, and more money stops you from having to obsess over expenses.

“Don’t buy too much house”

I read this rule somewhere and it stuck with me.

Many of us buy houses way beyond our means then spend a lifetime of working and stress to pay them off. But the average home is underutilized. Half those rooms don’t get half the use we think they will.

You’re better off getting just enough house and needing to perhaps upgrade one day than you are to over do it and end up with a McMansion that makes your hair go grey and pee go bright yellow.

When I went for home loan earlier in the year, I accepted 50% of the money the bank was willing to lend me. It’s how I avoided the American nightmare too many people accidentally live.

Just because a bank offers all that money, doesn’t mean you should take it.

Trading time for money never works

Our time is measured in currency.

Many of us earn in currencies such as USD. If we get paid by the hour for our work then we are limited by how many hours there are in a day. And all currencies, including USD, are worth less over time thanks to inflation and currency devaluation by central banks.

So the rule of financial freedom is you need to detach your work from the measurement of time.

This is easier said than done.

But it’s a skill you must learn if you ever want to outpace inflation and have a chance at a moderately wealthy life that doesn’t make you work like a wage slave forever.

One solution is to create a “protect from inflation kit,” according to blogger Neville Medhora. This is what his looks like:

– Hold stocks: GOOG, AMZN, AAPL

– Hold some crypto: BTC, ETH

– Own hard asset: House/Rental

– Own piece of businesses

– Hold S&P 500 fund: VOO (auto-buy monthly)

– Hold China S&P 500 fund: MCHI (auto-buy monthly)

– Don’t sell for 10+ years

My protect from inflation kit looks pretty similar. Rule: asset ownership unshackles humans from the value of time.

Your assets will look after your family even after you are gone — Kenney (Accent Investing)

As Jordan Gaskell’s said in a post: “You can’t be laid off from your assets.”

If you can’t stand losing money, you’ll never make real money

No one wants to hear this.

Not even me. It sucks big time but it’s true. Making money requires risk. Even a plumber that fixes your toilet carries risk. If they come to your house to fix the crapper and it blows up and covers your walls in brown stuff, they run the risk you’ll sue them.

Doctors have risks too. They can be sued if they screw up an operation.

So the solution isn’t to take zero risks. It’s to understand that risks are always present and they need to be considered and managed. And you need a financial Plan B in case sh*t blows up.

Too many people never invest in themselves and their education or their business ideas. So they never learn the skills that’ll make them the real money that lets them quit their cubicle job.

Rule: act like a venture capitalist and make small investments that carry risks so you can grow your wealth. There’s no other way.

We’re all fake investors until this happens

In 2021 there were a lot of gurus.

NFTs and cryptos went to the moon. Lambos were everywhere. Laser eye profile pics took over. Then it all went to hell and back.

The rule of financial markets is we’re all amateurs about to lose all our money until we’ve been through a calamity — recession, banking failures, currency crisis. The 2008 recession prepared me for the 2020 crash.

Live through a crash as an investor before you think you’re too smart.

Everyone’s a genius until the bank calls with a margin call and wants to repossess your house.

The more money you need the more you’re told what to do

Laptop lifestyle guys preach the no-job life.

What they don’t say is we are all slaves to someone or something. Even if you own a business the customers still run your world. If you don’t serve them or piss them off, they can create trouble and cost you a lot of cash.

The solution is to *not* need the money.

- If you have enough money then you can say no to a bad job offer.

- If you have enough money as a business owner you can say no to terrible customers.

- If you have enough money you can say no to more financial opportunities and say yes to more family opportunities.

- If you are in business you can start a company without having to take venture capital money and get told what to do by the men in suits.

Money makes us a slave. Not needing money makes you its master.

Making more money comes down to knowing what people want

Many people think they can’t make more money.

“It’s too hard. I’m doing my best, I tell ya.” Once you know what people want it’s easier to make money — and you already know the answer. Here’s what people want:

- More pleasure/comfort

- Less pain/discomfort

- More money

- More time

- Better health

See, there are no surprises. Help people get those things and you’ll make more money than you’ll ever need.

Closing Thought

One of the best books ever written about money is called “Die With Zero.”

It teaches us that money’s primary purpose is to be traded for experiences. Because if we spend all our time trying to make money, we’ll miss out on the experiences that make life worth it.

Make enough money so you can live well. Everything else is pointless.

This article is for informational purposes only, it should not be considered financial, tax or legal advice. Consult a financial professional before making any major financial decisions.