I don’t believe in kicking people when they’re down or destroying another person’s hope. This article is about how the American Dream has vanished (with stats to prove it) and what this means for you.

First, we need to define what the American Dream is. It’s the idea that anyone in America can come from nothing — that all you need to do is get a good job, buy a nice house in the suburbs, purchase a car, work hard, and by 65 you can retire with your house paid off. But…

The economic model has changed.

For millions of Americans this is no longer possible. The American model has been exported to much of the world, too. So places like Australia, where I live, face similar consequences.

These stats are going to make you uncomfortable (sorry)

Raoul Pal and his firm Global Macro spend hours every week putting together data to tell normies like us what’s going on.

Here are the headlines:

- Real wages haven’t risen since 1965 (source).

- Financial assets have steeply risen in price. This means the purchasing power of the real worker has gone down further (source).

- Retirement savings are so low that people will work well beyond 65 (source).

- When people don’t think they’ll ever retire they just get drunk on debt. That’s why U.S. debt levels are at record highs (source).

- The government is drunk too. They keep loading up on more debt to fund their circus show promises. All debt is backed up by collateral. The only way to keep the collateral from going to zero is for the government and central bank to print money (created out of nowhere) and use it to prop up the economy. Money printing is at record highs (source).

- When the amount of U.S. dollars in circulation skyrockets, the price tag of financial assets goes up too. This makes the value of wages in real terms even lower again. Those who don’t own assets become the “have nots” and those who have the assets become the “haves.”

- 26% of U.S. houses in June were bought by investors — not families. Monthly home loan repayments are up 50% in a year thanks to higher interest rates.

- Inflation has been at some of the highest levels in years. While it’s recently gone back down, for those who rent or are yet to buy a home, the costs are going parabolic and their version of inflation is much different (like 20%+ a year).

What this does to American society

When money is a problem for the average person it creates broader problems. Money takes over our minds and plummets our mental health. Want proof?

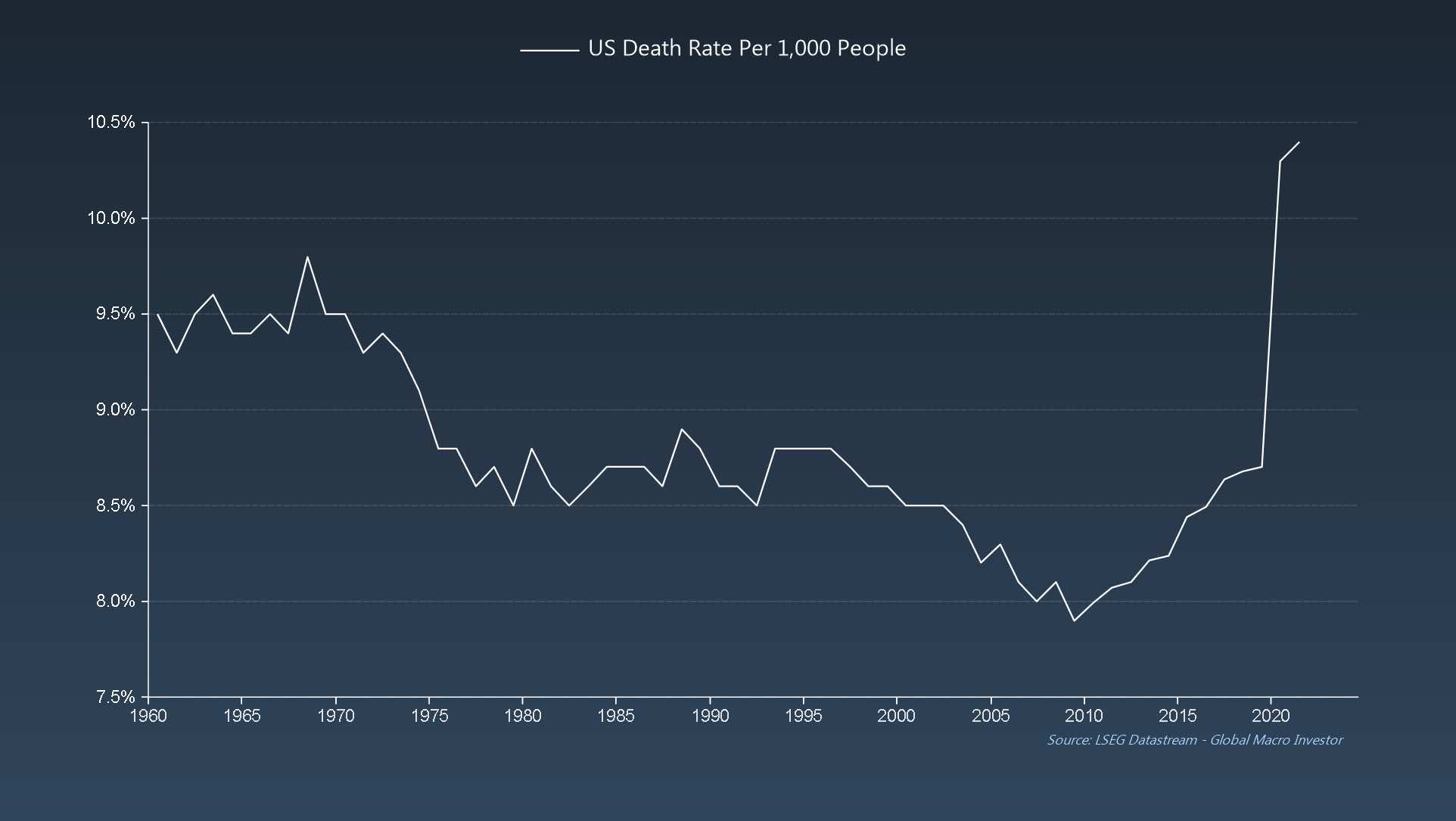

The death rate in America is out of control.

Image credit-Raoul Pal via social

Why?

When we feel like crap — because money is a problem — we do dumb stuff to our bodies. And we see the doctor who offers a magic pill: opioids.

That’s why if you go on the X social media app it can look like a madhouse some days. It’s a reflection of America’s reality.

We also don’t bonk each other’s brains out and have babies either when we’re pissed off or depressed about money. That’s why the birth rate is down.

To top it off, we’re heading into a 2024 election.

If the last one is anything to go by then we’re in for a sh*t show. Pissed off citizens are going to be gaslit into thinking all sorts of other issues like gender and race are to blame (and that’s partly true).

But the underlying issue is the money system is broken and everyone on Wall Street knows it. It’s worth noting Bitcoin probably won’t save everyone either. No one knows what the panacea will be.

I still believe a new financial system will take over at some point. One where central banks can’t move around monopoly money, and one where there’s true transparency of everything relating to money.

True price discovery doesn’t exist in the U.S. or the world right now.

Inflation and currency devaluation have made it hard to get a read on the economy.

- On the one hand you have an Average Joe who says “My house went up in price 75% since March 2020.

- On the other hand you have the sophisticated investor who knows not to measure the cost of anything in a government-issued currency.

Interest rates further complicate matters too.

You have the U.S. central bank declaring they won the war on inflation, that they helped avoid a recession. But then they also say unemployment needs to go up, so jobs will be lost to help stock prices go back up again.

It feels slightly evil. Yet this is the playbook.

The financial system is a never-ending boom and bust cycle that catches the uneducated by surprise and disguises the real game with complexity and fancy terms like quantitative easing.

The real issue here is the intervention by so-called “higher powers.” If natural market forces were able to play out, like they used to, then all of these unwanted massive ups and downs would even out.

But to have control of this money game gives enormous power to those who hold the assets. It can even swing elections.

The upside to this crazy situation

I promised a silver lining and here it is: to win votes the U.S. government will create money out of nowhere and throw it at the people.

It’s not buying votes — and it’s not illegal — but it’s the playbook any smart person in politics follows. And it doesn’t have any short-term cost.

When all this money enters the financial system it will boost asset prices, make people feel wealthier, and give free money to those who need it.

You may remember this happened in 2020 when Americans all got stimulus checks and there was one big party. We’re headed back to this disco. Good times, and great classic hits.

As always, though, the music will stop again and a recession will deflate Lambo egos. We’ve got used to it.

Takeaway

The American Dream as we know it is dead.

Not everyone can retire from work or pay off a home. Things may get worse before they get better. The benefit is, with change comes the opportunity for people to redesign this system to work for more people.

However, in the short term, the only takeaway for you is to own good financial assets (like high-quality tech stocks) at all costs. Otherwise hidden currency devaluation and inflation will destroy your purchasing power.

It means a financial education is now a matter of survival.

The alternative is to save and budget but there’s only so far that can get you. Eventually, it becomes a full-time job to find discounts and live on less and less. And your quality of living, frankly, sucks.

Know how the money game works.

This article is for informational purposes only, it should not be considered financial, tax or legal advice. Consult a financial professional before making any major financial decisions.