Your beliefs about money come from your inner circle.

When I spent my time hanging around broke losers at shopping centers, smoking ciggies and whistling at chicks, my bank balance was zero. It stayed that way for years.

When I got out of the gutter and began going to conferences, networking online and reading finance books, the financial advice I got was unconventional.

Here are the six best tips I got on money.

Living below your means is a superpower

Lifestyle inflation is the real epidemic.

I can afford a Lambo. Yet I drive a piece of crap Honda Civic. Most days I don’t drive. I walk or catch the train. I bought my wife a family car recently. The registration has the name of a car dealership from an extremely poor area.

“Should we take the sticker off honey.”

“Nah, leave it on. Looking broke is good.”

This is a counter-intuitive way to think about money. Most people are desperate to look fake rich to show off or create envy.

But when you live below your means you have less stress. You’re not a magnet for attention or random hate crimes.

The real superpower is free cash that creates a shift in psychology and quietly says, “you don’t need to work so hard Chief.”

Invest in what you understand

I used to invest in whatever was hot.

Facebook used to be a hot stock. I bought it like a sucker, and I regret it until this day. I think Zucks doesn’t give two f*cks and is awful for humanity. The global population is starting to think the same about him.

That will be bad for Facebook (Meta) stock long-term.

On the other hand, I am a big believer in the future of the Ethereum crypto. People think I’m nuts. What they don’t know is I have over 10,000+ hours of research on the project.

I’m not guessing the future of Ethereum will be bright.

I’ve studied the odds and the chance of my asymmetric bet being right is extremely high. It’s why I can confidentially say the price will continue to rise exponentially and why I invest in it, even when the market plummets.

The best way to invest is always to do your own deep research. That way, your confidence is real & you won’t sell when some schmuck says it’s going to $0.

Interest rates and the value of money are a clown show

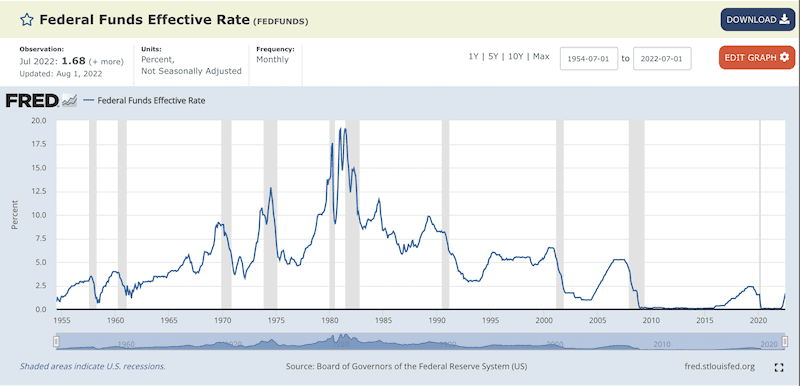

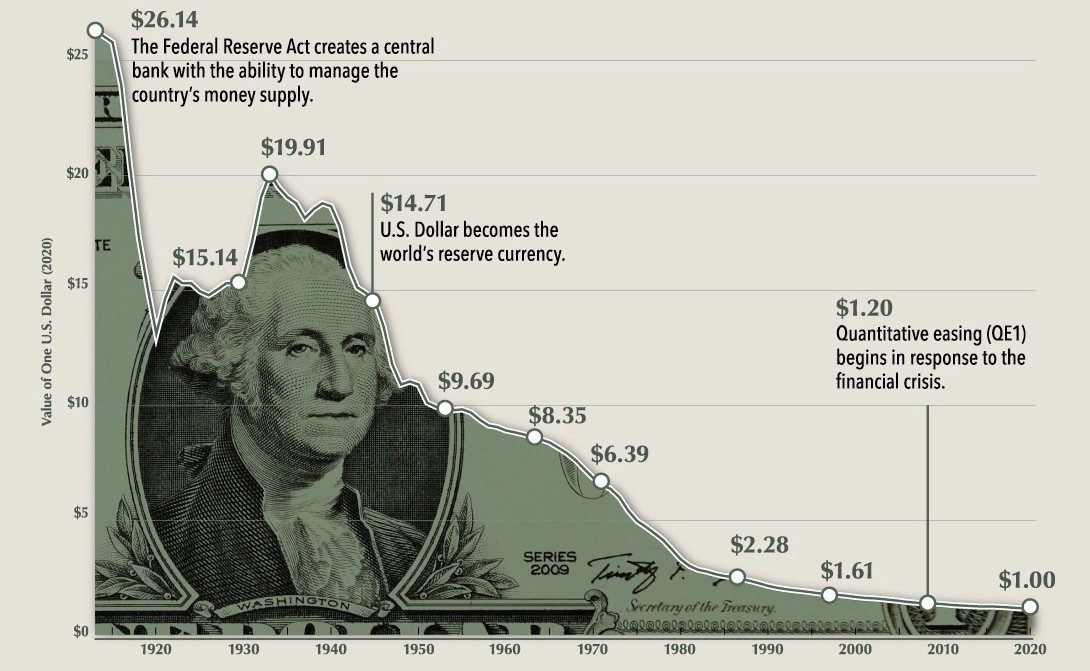

Interest rates and the value of money are the two pillars of the global financial system. Both are experiencing a rapid decline — and most people don’t know.

Interest rates have been trending lower since the 1980s. And the value of money is worth less every year.

When you hear the word inflation, I was taught by people smarter than me, to translate it to “money just became worth less as a form of tax.”

- Left image credit: FRED / Right image credit: VisualizeCapital

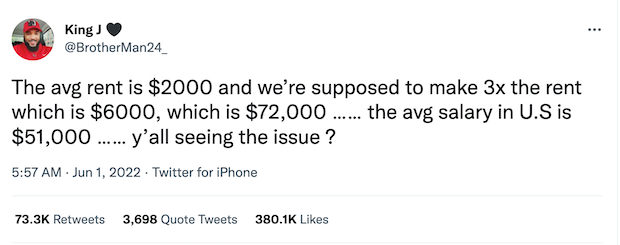

What all this means in simple terms

Economics makes my eyes bleed.

Let me translate: raising interest rates and stopping the devaluing of the dollar are now near impossible. To get both graphs above to start going up again would require a brand new form of economics.

So, we’re stuck in a cycle of money being devalued by governments to fund the future and low interest rates.

That means interest rates are highly likely to go back down again to get the global economy out of recession. And creating more money out of thin air to give out “inflation relief” to citizens is almost a given.

America, for example, hasn’t been able to stop creating money out of nowhere since 2008. Some would argue that the 2008 recession set us on this current path — that we’re unlikely to escape without a new monetary system.

Takeaway: Expect interest rates to stay low. Expect money to continue to get devalued. Therefore, invest in assets or get wrecked.

Tweet credit: Brotherman24_ (explains everything simply)

One form of income will always make you wealthier

I don’t tell people to get online income streams to look cool or sound hip.

Nope.

Online income streams are powerful because they utilize the laws of compounding and leverage.

We’ve all come across leverage. It’s where you put down a $100K (20%) deposit on a $500k house and then the bank lends you the other 80%. As the property increases in value, you profit from the full $500k, not just the $100k you invested. Smart.

This law of leverage applies to the internet. You put in a sustained amount of effort over time, but the results increase without you having to work harder.

Why?

- The internet is a network. The virality and shareable nature of anything online does the extra work for you.

- A large number of people still don’t have access to the internet. As they join the network your efforts further get amplified without doing anything.

The internet doesn’t just produce leverage. It produces the law of compounding made famous by Albert Einstein.

Compounding is where the output gets reinvested back in and starts to produce more results without your intervention.

- Content compounds.

- Testimonials compound.

- Website traffic compounds.

- Shareability of ideas compound.

All thanks to the internet. Therefore, the money you can make online requires less work and attention over time if done right.

“Wealth is not about having a lot of money. It’s about having a lot of options.”

I have a few rich employee friends. They drive the coolest cars and dine out at skyscraper restaurants in the clouds.

They think they’re wealthy. But they’re not. I’ve been trying to get into one of their diaries for the last 9 months (and we’re good friends). No matter how hard we both try he simply can’t make it happen.

Work is always a dominating force. He works every day of the week. If the phone rings he has to drop everything. If he wants time off to go on a vacation, it’s near-impossible. The whole business relies on him which is why he takes home a fat paycheck.

He can buy anything he wants, but he has zero options to do what he wants.

This is extreme poverty, not wealth. You want to use money to create options for yourself, not get stuck with no options and a full calendar based on someone else’s agenda.

Associate every purchase with time, not money

“That car costs one year of my life.”

I said that to my wife when trying to buy a family car. That’s how you talk after you get indoctrinated with the “money is time” mindset.

What if price tags had minutes and hours on them as the currency? Now everything looks different, and you’ll stop buying dumb sh*t. Trust me.

Here’s a weirder thought: Don’t die with money in the bank (also known as unused time). Spend all your time to know you’ve maximized your life.

This article is for informational purposes only, it should not be considered financial, tax or legal advice. Consult a financial professional before making any major financial decisions.