I’m a pretty optimistic guy.

But the banking crisis is getting worse and has severe ramifications. If you want to keep the shirt on your back, it’s worth paying attention to what I’m about to share with you.

We’ll start with the doom but I promise this get’s positive soon.

Banks falling like dominos

Let’s focus on the US because they’re the financial center of the world.

Silicon Valley Bank was the first to go down with fireworks and VCs bragging in tweets about how they helped save people. I thought “you know, this is nothing. Small bank. It’s not 2008 again.”

A few days ago First Republic Bank went down. Then this happened:

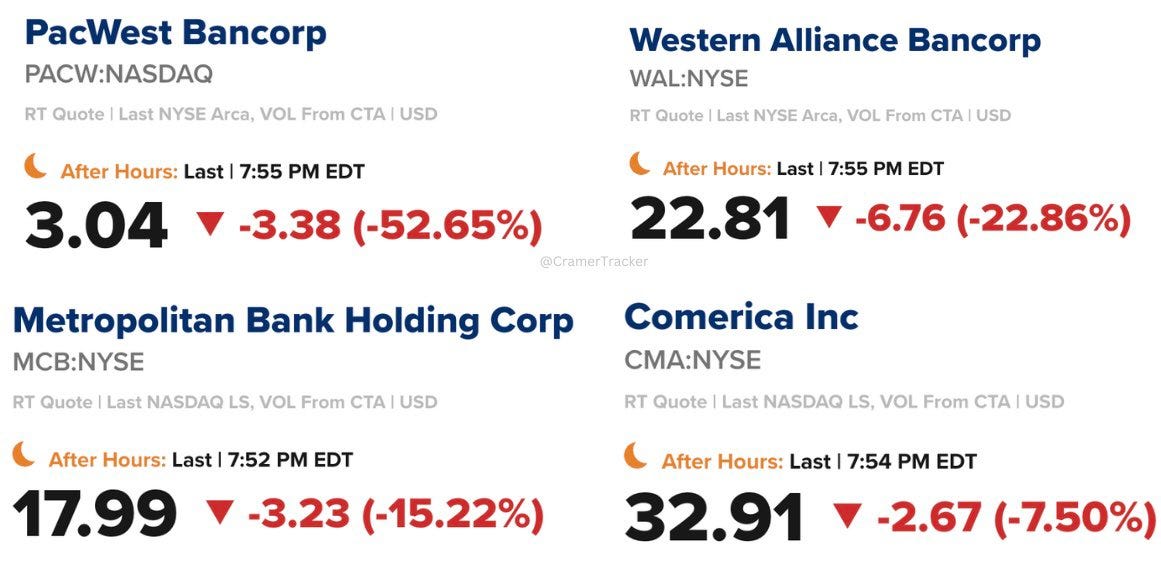

PacWest Bancorp, $PACW, now down 29%, stock halted.

Western Alliance Bank, $WAL, now down 25%, stock halted.

Metropolitan Bank, $MCB, now down 24%, stock halted.

Image credit — @CramerTracker via a tweet

This ladies and gentlemen is a sh*t show.

$548.5 *billion* dollars of assets in just 3 bank failures. In 2008, 25 bank failures hit $373.6 billion — Meet Kevin

It’s all caused by the rapid rise in interest rates. Trust no bank.

The natural response would be to provide some relief or at least pause any more interest rate rises. So what did The Fed do?

Jack up nearest rates further. Take that suckers.

Many experts warn that the current scenario of inflation slowing while interest rates continue to go up could be catastrophic to the economy.

That’s exactly where we are heading folks. Hold on tight.

Rich grandpas caused this

The Federal Reserve sets the interest rates.

They’re all old men with bad breath. They’re out of touch and using door-to-door surveys (no joke) to make decisions. Here’s what they’ve told us recently:

- “Rates won’t go up until 2024 (back in 2021).” WRONG.

- “Inflation is transitory.” Right after inflation hit a 40-year high at almost 10%.

- Recently they said “the banking system is fine. It’s all okay.”

- Today, as I write this, regional bank stock prices are down 40%.

You can’t trust The Fed or any central bank. They just tell us what we want to hear with their clickbait remarks.

As they’ve cranked up interest rates it’s hurt many people. Sure, rates need to go up sometimes. But if you rocket the rates up in a matter of months at the fastest pace in history then no one has time to prepare.

As the rates have gone up small and middle-tier banks haven’t had time to adjust their investment strategy. So they’ve been bled dry by losses in treasury bonds they bought.

Central bankers don’t give a crap about what high interest rates do to people. The leader of the Federal Reserve is worth approximately $50m. If the worst happens he’ll be sweet mate.

And senior members of the government who influence policies around money are in similar positions. Nancy Pelosi has one of the highest-performing stock portfolios ever.

Some say she’s a genius. Others say she uses the information she has access to, to buy stocks (insider trading). There’s a bill been proposed to stop government officials buying stocks while in office.

But for the time being these elite, wealthy, rich-as-hell folks get to tell us what to do and raise the interest rates.

The fact these high interest rates will spike unemployment means nothing to them. The fact more banks will fail and risk losing people’s money (if the new bill to increase deposit insurance isn’t passed to protect them) means nothing.

The house always wins in poker. And the leaders making these decisions are the house and can do whatever they want with zero consequences.

They say Bitcoin is rat poison. Think what you want about the popular crypto, but at least nobody controls it. Power too easily corrupts.

This will happen to banks

More banks will fail.

But nothing bad will happen. Anyone who has money with these banks can still access it. The central bank and government will just bail out any bad banks like they did in 2008.

There’ll be no penalties for bad management. Bank bonuses of senior executives won’t be clawed back.

And this is the problem.

When there’s no penalty for going out of business, what’s stopping the bigger banks doing stupid things and investing in risky assets too?

Nothing.

And therein lies the problem. If you can screw up and not even get a slap on the wrist then you’ll gamble like a drunken sailor.

How the banking crisis smashes the middle class

So you read this and go “I don’t give a fudge about banks, Tim, or all your financial jargon. You bankers are all trash.”

Yes, as an ex-banker, we are trash, perhaps.

But all of this matters to you. As banks go down they will get bailed out with what? Money. Where will the money come from?

Not taxes. The US already has massive debts that may never get repaid. So they’ll just create more money from nothing.

Can they do that? Hell yeah party people. They used to have to physically print $100 bills with the printing press. Now it’s super-easy. Listen to this … haha … you’ll love it.

An employee at the central bank just goes to the computer screen and adds more zeroes to their bank account. Then they transfer money to whoever needs it.

Now obviously there’s a little more to it. They do it with their balance sheet and they can exchange bonds instead of cash, and it’s all supposed to be a loan. But it’s not. Underneath it’s just adding zeroes to a bank account.

Those zeroes matter though.

Because when more money enters the money supply all existing money goes down in value. In 2008 the effect was minor. In 2023 the effect is huge. When you see these giant months of almost 10% inflation, that’s the free money screwing things up.

When you see record-high interest rates that went up faster than a teenage boy’s boner after watching Baywatch, that’s the aftershock of the free money.

So if the value of money is going down then the middle class is getting poorer. There comes a point after 15 years of this game where it has a massive impact on people being able to buy the things they need.

If this game continues then there will be two classes:

- The rich who have assets that help to (somewhat) protect them from the devaluing of money.

- The poor who don’t own assets and are holding dollars that are melting like ice cubes.

The smart way to prevent all this chaos

The solution is to stop bailing everyone out and playing god.

If a bank goes down then good. Let it be a lesson. Let people lose money so they’re more careful who they trust with their cash.

And if big companies fail because the economy crashes then good. Let’s wash out all the bad businesses like Uber that are built on a mountain of debt they’ll likely never pay off.

America keeps rewarding bad people and companies for bad behavior.

It has to stop. If you take a risk and it blows up then you’ve got to cop the penalty. Because if we’re not allowed to fail, then we’ll become delusional and gamble like Saturday night trash bags at the casino.

This explains the last 2 years of financial markets. People thought they were so damn smart with their investment strategy.

But all that occurred is governments and central banks said “failure is not an option.” They wanted to be the good guys, but underneath they became the bad guys, by screwing with and taking a piss on the money supply.

Now it’s hard to know what things are worth any more. Price discovery is a haze.

The optimistic case for the rebirth of the middle class

I’m not a doomer here to poop on your parade. There are ways this whole banking crisis could become the panadol we all need.

1. Power shifts

People are waking up to the extreme wealth of the leaders who represent them. If the banking crisis continues there will come a point where leaders will have to step down.

Their empty promises and lukewarm solutions won’t be accepted anymore. This is good. It’s a way to flush the system of all the turds.

2. People eventually stop putting up with it

The 2008 financial crisis became huge.

By the end of it the general public had enough. The Occupy Wall Street movement formed. The leaders in power couldn’t avoid the topic anymore.

Unfortunately, no action ever came from the protests.

The Wall Street crooks who stole from people got away. But the memory lasts a lifetime. People are wiser now. If this banking crisis continues to heat up, we may actually get some real change.

When the people have had enough a new situation occurs.

3. A transparent financial system will emerge

The biggest problem with the financial system is there isn’t a transparent ledger to show who has what and who owes who.

While I don’t think the world will move to some cryptocurrency like Bitcoin, I do think the underlying blockchain technology will gain mainstream adoption.

When we can publicly see the real assets of people and banks, it is harder to manipulate the story of one’s financial position.

That means when cracks appear in a bank the regulators can step in sooner to solve the problem, rather than when it’s too late & only a bailout will do.

Central bank digital currencies will also create more transparency because the overall money supply will be easier to track, so some chump won’t easily be about to add a few zeroes to an account and have no one notice.

4. Layoffs will be good

Like I said, unemployment is going up.

This is a bad thing but the upside for the middle class is it’ll give people a chance to work in new industries and try other companies. That’s a good thing. It’s easy to get stuck in a comfortable job for life and waste your life.

Layoffs may humble people too. Those affected may not worship the consumerism world we live in as much, which is a good thing.

5. Everybody loves a discount

Price rises are out of control.

Big companies love these times in history because it gives them plenty of reasons to crank prices and increase profits for doing nothing.

As they crank interest rates to fight the boogie man of inflation, consumer demand will get destroyed. This may actually result in decent prices and value for money again. What a positive that’d be!

No more “Tim it’ll cost you $70,000 for us to paint your tiny house.”

What comes after the banking crisis is a must to know

The banking crisis is level one.

Anyone who’s worked in finance or been around banking knows the Big Bird inside the boardroom: commercial real estate.

Image credit: Gamestop meme via a tweet

Since 2020 work-from-home culture has changed how many people work in offices and for how long. So no company needs as much office space as before. Many companies will have no office going forward.

This has left lots of dead office space worldwide, particularly in the US. Someone has to pay for that huge problem and it’s the one whose money is invested in those offices.

Even if you think it’s not your problem, it could be, through your lovely black box retirement fund that parked some cash in commercial property.

Everyone knows this is a ticking time bomb.

Nothing you can do about it other than get your money out of commercial real estate until the storm passes.

Bringing it all together

Much of this may sound like doom and gloom.

But actually, this whole situation is eventually all boom. The current status quo can’t continue. Change has to come and it will be forced by this bank crisis — the best kind of change.

Make sure your money isn’t all with one bank. Perhaps consider the bigger banks for now. And be careful with commercial real estate.

The middle class will only be destroyed if change doesn’t happen. It’s you and I that ensure change comes. Use your power to make sure it does. Vote with your wallet. Put your money in a place that represents what you believe about financial equality.

And tell those bankers and politicians: bailouts are not okay, m’kay?

Stay safe out there.

This article is for informational purposes only, it should not be considered financial, tax or legal advice. Consult a financial professional before making any major financial decisions.