Becoming wealthy is cringe.

Who wants to be on the Forbes list and drive a wank on wheels? Not me. The hidden desire of 99% of wealthy people is to have time freedom.

To do things out of love, not obligation.

To control their time and do as they please. So to get there one must understand how money works.

Across my career in banking and networking with wealthy people on the internet, here are the 9 money lessons they taught me (should be mandatory for all schools to teach them).

Skills = Money (but there’s a big problem)

I met Dan Koe online a few years back.

He mixes wealth with spirituality and philosophy which I’ve never seen done before. This idea from him left me speechless:

Most people aren’t increasing their skill level, they are increasing the amount of time they spend at their current skill level.

Read that line a few times. Does it sound like many of the people you work with? It’s why “experience” is so damn overrated. Beginner-level skills repeated for the length of a career won’t make you wealthy.

People go crazy over working hard, but as the cliche goes, you have to work smarter not harder. To get wealthy you have to constantly upgrade your skills, and stack new skills on top. Focus on skill acquisition.

The path to monetization isn’t what you think

I see it with creators all the time.

As soon as they have a tiny bit of success online they want to cash the check and retire. So they spam people with ads and multi-level marketing scams.

@boredelonmusk tweets memes for a living. You’d think memes couldn’t make money, but his account is valued at $20M. He makes millions of dollars a year from it.

Wait, what? How?

The social media account gives him early access to startup investing opportunities. Imagine investing in Stripe when they had two employees. That’s the sort of deal he gets access to.

Wealthy people make money from their network. Wealthy people use social media to attract opportunities to their email inboxes on auto-pilot.

Stop short-changing yourself by trying to charge fees for everything.

Assets over Labor

We’ve all heard trading time for money is bad.

It’s easy to not quite understand why though. Naval taught me that income that comes from labor is destroyed by inflation, whereas income that comes from quality assets — stocks, bonds, real estate — protects you from inflation.

So the wealth game is to acquire assets. Everything else you can buy with money is weak in comparison.

Assets enable early retirement. Assets eventually equal financial freedom.

Asking for $50K is the same as asking for $200K

This one has universal application.

Steve Schwarzman founded financial giant Blackstone. His book, What It Takes, talks about how in the early days it took him the same effort to ask investors for $1M as it did to ask for $100M.

Now, you’re not a billionaire, so how does this apply to you? It takes the same effort to get a $50K job as it does to get a $200K job. Higher salaries are no harder to ask for than lower ones.

So choose the biggest payoff.

Don’t be afraid to go for the big money. Negotiate hard to get more money when you get a job offer. Insist on incentives and bonuses. That’s how you bank more cash and work less over your lifetime.

“Poverty charges interest”

(Wealth pays interest.)

I picked up this phrase from Tay Zonday. When money is a problem it creates more problems. She says if you can’t pay to have your teeth cleaned then next year will be a root canal.

If you can’t fix a simple car engine problem then next year you’ll pay for a new car. Can’t pay for a cancer check? Next year pay for chemotherapy.

Downward spirals, spiral out of control.

The money game isn’t hard to figure out — but ignoring it is the stupidest thing you can do. Money makes your world work. Get a financial education so wealth can start paying you interest instead of charging it.

Investing in stocks can ruin your life

Wait, what?

It’s trendy to save or “buy the stock market index fund.” You’ll get some nice returns. 5%-8% maybe. But you’re selling yourself short.

My buddy Nicolas Cole had $5000 to his name when he was in his mid-20s. He had it all invested in Apple stock and thought he was Warren Buffet.

Now he says it was a stupid decision.

$5000 could have helped him increase his income potential through courses, coaching, masterminds, and getting new skills.

That $5K could have become $500K if he did.

Investing in YOU is always the best investment with the highest ROI.

This advice applies to business owners too. Invest in leads, salespeople, or building a newsletter. That’ll make you more money than withdrawing dividends and buying real estate.

High-status companies make you broke

If you go on LinkedIn you’ll see a bunch of weirdos taking selfies of themselves in front of Apple, Airbnb, Microsoft, and Google logos.

It’s weird as hell.

They think they’re cool but what they don’t realize, according to tech startup legend Kunal Shah, is these companies can underpay people because of how many other weirdos want to work there and get the bragging rights.

Never choose status.

That’s how you go broke and end up buying luxury items to boost your ego. Choose the company that’ll help you learn the best skills which are high-demand in the marketplace.

Then a high income becomes a no-brainer.

“Rich people get paid by the project and pay by the hour”

(Naval)

Find ways to get paid for outcomes.

Being paid by the hour is the worst form of compensation. There are only 24 hours in a day. Find ways to solve big problems that take a little time to fix.

The greatest wealth unlock in history (not joking)

Let’s finish here.

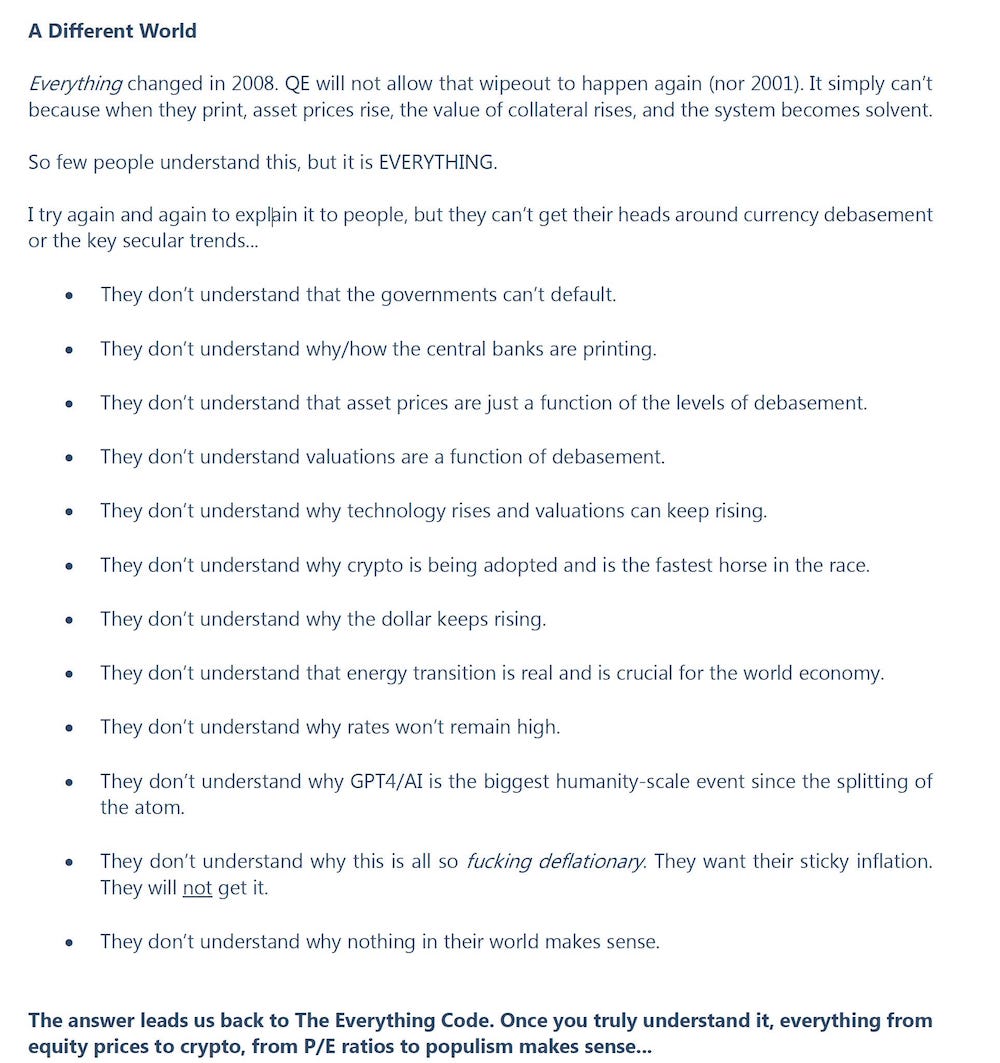

The guy who has rewired my money mind the most over the years is Raoul Pal. When he released these few sentences below it changed everything.

(Read this carefully.)

Image credit-Raoul Pal via a tweet

Some of that may go over your head and that’s fine.

The key point here is that all government-issued currencies are created out of thin air and legitimately manipulated.

It’s why your income goes up but you don’t get richer. It’s why interest rates will never be high again and will come back down.

It’s also why technology stocks, blockchain, and developments in AI can help bridge your wealth gap if you let them.

Study Raoul’s “Everything Code” and you’ll work less days in your life. I wish I had known this back in 2008.

This article is for informational purposes only, it should not be considered financial, tax or legal advice. Consult a financial professional before making any major financial decisions.