Most people don’t know Pablo Picasso was badass.

After Picasso was famous, he returned to the original studio he used to occupy as an amateur. Out the front there was a homeless guy on the bench. The man was a starving artist. He couldn’t catch a break.

Picasso walked over to a rubbish bin near the homeless man. He pulled out a piece of scrap paper and spent the next few minutes drawing a beautiful work of art for him. Picasso signed the bottom of the artwork.

“Here you go, buy yourself a house.”

This story sticks out to me because it’s not the traditional definition of rich or wealthy. But it’s now my definition.

The hard part about poverty is you act from a place of scarcity. You’re always trying to get something from someone. Everything comes down to money. Money is on the brain every day and makes you go insane.

Having enough money to help those in need, or to kickstart the careers of the next up-and-comers in your field is true wealth.

These money tips have helped me more than a finance degree ever could. They’ve been so helpful I decided NOT to get a finance degree at all, even though my bank employer said a degree was a good idea. Screw them.

Worrying about pennies is a huge distraction

The “stop drinking your $4 cup of coffee every day” advice is stupid.

Let’s do the math. If you buy a $4 cup of coffee every day for 10 years, it’ll cost you $14,600. That isn’t gonna make you rich! Even if you invested the $14k in an index fund it’s still not going to do much for you.

Stop falling for this poverty advice.

Drink your coffee. Enjoy life. Focus on ways to make more money, not save $4 a day and skip coffee shop chats that could lead to new opportunities.

Talking about saving money is for losers. Hang around people who want to make more money online instead.

Understand the psychology of employment

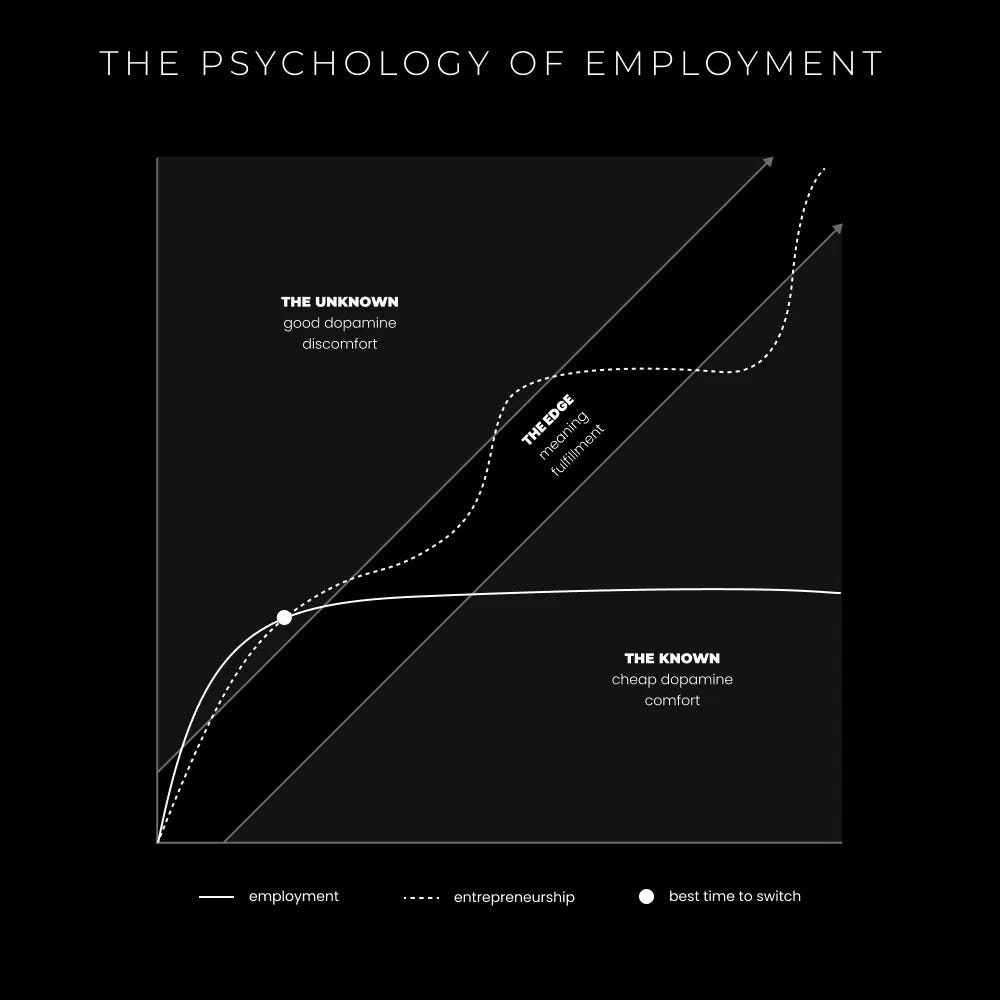

A job is level one in a multi-level game. But the reason why isn’t obvious. This graphic from Dan Koe explains why.

Image Credit-Dan Koe

There’s a threshold we all reach early in our careers where there’s not much new to learn. It’s where routine, familiarity, and comfort set in.

This often leads to boredom and a huge decrease in creativity, curiosity, and imagination. Dan calls it the “known phase” when the desire for cheap dopamine sets in and takes over.

The best time to switch from employee to self-employed is at the intersection of when you spend more time in the known at work than in the unknown. If you time this right you stay in the edge zone.

That means the ongoing weaving in and out of comfort and discomfort. It’s where meaning, fulfillment, and flow states are found.

Unless you understand the psychology of employment and where the edge zone is, you’ll never make real money.

Wealth isn’t created by living for decades in a zone of comfort.

At some point you’ve got to transcend level one employment and progress to level 2 (multiple income streams), and eventually level 3 (one-person business), or even level 4 (entrepreneurship and employees).

Everything is going up except your salary

This is a bitter truth they don’t teach in college.

My wife’s had the same salary for the last year. Last night she said to me “Honey, I got a 6% pay cut this year.”

She’s talking about the fact Australian inflation (where we live) averaged roughly 6% over the last year, yet her salary stayed the same.

The year before her kind employer gave her a 2% raise to cover inflation. That year inflation was 8%.

Many people don’t understand this. If you get the same salary for a while (like most do), it’s going down by default. And even if you get an inflation raise every year, it’s not enough.

Let me screw with your mind further.

The government calculates the official inflation number. They have a huge incentive to downplay it — and they do!

To collect the inflation data they manually hand out paper surveys to businesses asking about price rises.

Real inflation is hard to measure. There are some tools that try to measure it, and they typically show real inflation is at least double whatever the government conveniently says.

If you add the decades of wage stagnation to the argument, what you end up with is one huge takeaway:

Understand the value of your salary versus inflation, and upgrade from level one employment as soon as you can.

A single-income salary keeps you poor.

An empty room with internet will make you more money than a mentor (or any other shiny object)

Free mentors are overrated.

They have little to no incentive to help you. Pump up rah-rah motivation doesn’t help a lot either. One of the best things you can do is rent a cheap, one-bedroom apartment with a bed, desk, and nothing else.

With all the distractions gone and a little hard work, there’s a lot of money to be made on the internet.

What looks like the “rich life” is actually just buying time

My best friend’s husband recently hired a full-time nanny. My inner circle went nuts.

“How dare they!”

“Wow they’re making too much money.”

“What snobs.”

Her husband didn’t get a nanny to show off or look rich. They’re not wealthy and both work demanding jobs. The reason they paid for a nanny was to buy back time.

The time they save by having a nanny who cooks, cleans, and looks after their two young children can now be reallocated into better money-making activities. With extra time they focus on what they’re good at, because frankly, they both admit they suck at housework.

A scarcity mindset will say hiring help is the rich life. A wealthy mindset will see outsourcing as a way to buy back time and get a better ROI.

Choose your mindset wisely.

Being frugal isn’t as clever as it sounds

Author Morgan Housel can have my babies any day.

He says “Frugal, by my definition, means depriving yourself of something you want and could afford.” Not so smart after all.

The point isn’t to be frugal and show off about it.

The real goal should be to get better at not gaining pleasure from material things. That leaves you open to gain pleasure from hobbies, a career, family, and the simple things like a walk in nature.

No degree teaches that. College just wants you to be a cog in a machine where you get told what to do. But true wealth is freedom and not being told what to do.

This article is for informational purposes only, it should not be considered financial, tax or legal advice. Consult a financial professional before making any major financial decisions.