My nickname should be Captain Broke.

I’ve been there many times. It hurts the most when you have a decent amount of money and then have to start again.

The truth is most of you reading this started out as dead broke. Maybe you’re still there.

Lots of debt, low to no savings, working a job you hate to barely survive, having no money left after you get your paycheck — these are all brutal things to deal with. Let’s not sugarcoat it.

But just because you’re facing a tough situation, doesn’t mean these things are reasons to give up on life.

Starting from broke makes the eventual victory feel sensational.

Let’s start with exploring what leads us to go broke, then we’ll get to how to escape and rebuild your financial future.

The #1 one way to go broke

The easiest way to be broke is to embrace a lifestyle you can’t afford — Kenny, Accent Investing

Why do we play these lifestyle games? To impress others or to make our parents proud.

If your expenses are higher than your monthly income, you have a problem.

All you can do is reduce expenses.

It will hurt like hell, but it’s one of the only ways. You could increase your income too, but if your financial habits are bad then your expenses will likely rise again, magically.

Measure money in, measure money out.

The naughty crypto millionaires don’t tell you this

Crypto is the fast lane. No doubt.

I’ve seen people go from nothing, to $100M, and right back to zero again. You can make stupid amounts of money. But most lose it all. Why? Business Famous on Twitter explains:

“The fastest way to go broke is trying to get rich quick.”

When you accelerate your path to wealth it causes blind spots. Your ability to see risks becomes reduced. It’s easy to get caught up in the hype. Money can be a drug more powerful than coke if you’re not careful.

Money can buy everything and nothing all at once.

The mindset that creates financial resilience

I’ve spent a lot of time with people who have gone broke and then risen to the top again.

Something is a little funny.

They can go broke or owe huge amounts of money to not-very-nice people and stay there mentally without losing their mind.

It’s because they knew their bad situation was temporary. Their financial life is run by optimism, not despair.

When the worst of times hit, if you can believe the best of times is right around the corner, you can survive anything.

What you think becomes a reality.

Accept being broke

When I had close to no money after I walked away from a business I loved, my actions changed.

I could accept being broke, by investing what little money I made from my minimum wage working in a call center, in financial assets. Those assets took time to go up. But when they did it rewrote my financial future.

Understanding real assets gives a broke mind a safety blanket.

The true definition of broke

When we say we’re broke, often, we’re wrong.

Seneca said, “Being poor is not having too little, it is wanting more.”

Sometimes the problem is not that we’re broke, it’s that we want too much because we think others have more than us. This is a lie you tell yourself. Consumerism happily backs it up through ads so they can profit off your fear.

Maybe you already have enough.

Here’s how to go from $0 to 7-Figures

Let’s reprogram your financial psychology.

Start with a job. It’s okay.

It’s cool to diss jobs. Hey, I’ve done it a few times.

Most of us start with a job. There’s no denying that fact. The point isn’t to hate a job. It’s to use a job as your base. That’s where side hustles became popular.

The formula most of us (including me) use to stop being dead broke is to work a vanilla job, and then build an after hours side hustle.

If you do it for long enough then the side hustle becomes your main job, and your traditional job becomes your part-time job. Then once your side hustle is cranking it’s fine to cut off your job … or keep it.

Tell your boss you’re giving yourself a raise AND a promotion

A job can give you a raise, although it’s like getting blood out of a pair of Nike shoes while stabbing yourself in both eyeballs.

The simple way to get a raise is to lower your expenses. If you want a promotion at your job, too, then invest more money in financial assets.

Become a deep researcher

Collect data with Roam Research. I’m not an online business owner or writer.

I lied.

I am a researcher. All of my skills and everything I know are thanks to deep research. I spend a lot of time consuming content on the internet.

In isolation this seems like a bad idea.

What I do differently is plug all of that information into my research app, Roam Research. But I go one step further.

I synthesize the research. I put it into buckets. I curate. I delete. Then I rewrite a lot of what I learn in my own words so the ideas stick to my brain permanently. Mastery in any field requires deep research.

If you’re not researching right, you’re giving yourself a financial handicap.

Research builds conviction.

Conviction enables patience.

Patience builds wealth.

— Brian Feroldi

Compound your focus to reach 7-figures faster

Money shouldn’t be measured in dollars.

The currency of real wealth is focus.

If you can’t sit down and focus on a task for an extended period, it’s near-impossible to make a lot of money or be successful at anything. In the future, focus will become a measurable KPI in the business world.

Until then it’s one of the best-kept secrets of those you admire.

Focus requires discipline.

Make focus a habit you do every day, and there’s no limit to the value you can create in this world.

Start by mastering flow states. Learn everything you can about this superpower.

Focus compounds faster than money — Jack Butcher

Learn how to go from active income to passive

Plenty of people make money online.

What they don’t tell you is their income is all active. This means if they don’t work hard, they don’t get paid.

The difference is passive income. It’s where you use leverage and work you’ve already done to continue making money while you’re goofing off at the cinemas or making sweet, sweet love to your partner.

The trick is systems.

Document all the tasks you do to make money. Apply automation slowly over time to the ones software can take care of.

For everything else, use the documented systems you’ve written down to slowly outsource certain tasks to freelance marketplaces.

The point is to focus your time on the skills that matter and outsource/automate the tasks that drain your energy and cause you to work too much.

As the automation increases, active income turns into passive income.

Understand the modern internet money making machine

“Business model” is just a fancy phrase for internet money making machine. I hoard business models like collectible Superman trading cards.

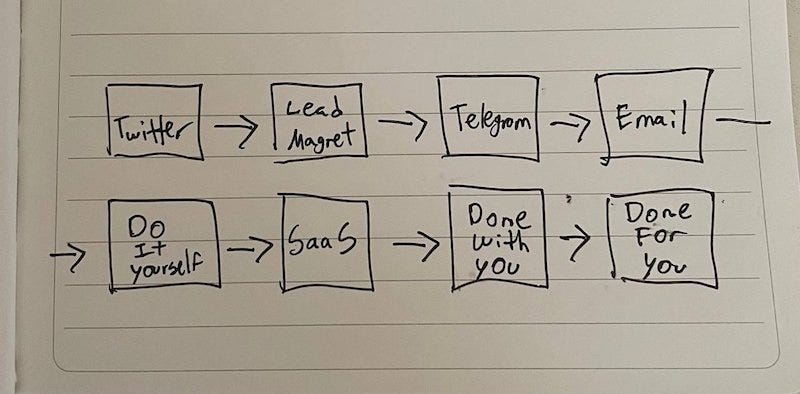

Every source of money online is a dumbed-down funnel.

This funnel is gorgeous.

The creator simply publishes free tweets on Twitter, sends the audience to a landing page, gets their email address and adds them to a Telegram group chat, engages with them some more, then sells them software.

The software he sells can either be a do it yourself version, or where he works with a person to build software as a team, or where he does the entire software build without the client and then hands them the finished product.

The point isn’t that he sells software. What you sell online is irrelevant.

The point is he has an internet money making machine where every step of the journey feeds into the next and compounds.

Takeaway: Content is at the start of any internet money making machine.

Closing Thought

Let’s stop the nonsense.

Most of us start with no money unless daddy gave you a trust fund. In that case, good for you. If not, it all boils down to this.

Get out there, swallow your pride, work a job you might hate, get a financial education, invest in financial assets, build for at least 5 years, and stay patient.

That’s how people no smarter than you go from broke to 7-figures.

This article is for informational purposes only, it should not be considered financial, tax or legal advice. Consult a financial professional before making any major financial decisions.