Renters are stupid. They own nothing.

Homeowners are dumb because they got themselves into huge debt.

These are the two sides of one of the biggest debates on the internet, as shown by this tweet. This discussion isn’t new either.

It seems humans are obsessed with homeownership. It’s a shiny object we can’t take our eyes off. And there are layers of spruikers and real estate fortune tellers that have been brainwashing us for years.

Homeownership is at the heart of the American Dream.

So it’s no wonder we fight like little buggers whenever anyone questions this sacred, holy art form. I’ve been on both sides of this debate.

I rented for years and amassed a decent return in financial markets. But three months ago I got a home loan and bought a house.

Let me explain what’s going on here.

Renting isn’t better than homeownership

Rich guy Nick Huber hates renters.

A mortgage payment doesn’t go up for 30 years.

My parents still pay $420 a mo on a 200-acre farm + house they bought in 1998. Rent goes up 5%+ per year. Compound that over 30 years and it’s 4.5x higher.

People who argue that renting is better are simply wrong.

The argument here is that homeowners have relatively fixed costs that are predictable. The price you buy the house at and lock in the loan for typically lags the increase in the price of the home.

Obviously, this isn’t always true but it’s a decent assumption in homes near major cities. If you own excess homes as a landlord then rents do generally go up over time.

The problem with renting is you’re paying off someone else’s loan. You don’t own any of the building or the land.

The goal with money is to become an owner. Otherwise, you become a renter and have much less control.

When I rented last year it was a pain in the ass. Stuff would break all the time and the landlord was too broke as a single mother to fix it. So we lived in this rundown hellhole.

Every month the real estate knobhead would want to inspect.

When you’ve got a newborn baby who sleeps worse than Elon Musk, that’s a giant pain in the butt. Especially when the agent picks at dumb stuff like “Why is this leaf next to the front door?”

“It blew under the door, sir. Sorry.”

Business expert Daniel Vassallo also makes a brilliant point:

This is also why measuring inflation as a single number is silly.

A big part of inflation is housing costs, and for many homeowners, housing costs are not increasing.

Inflation isn’t murdering our back pocket. Housing costs are.

If you rent it hurts more. As interest rates go up your landlord profitability goes down. So what do they do? Make it your problem. Raise the rent. Soz.

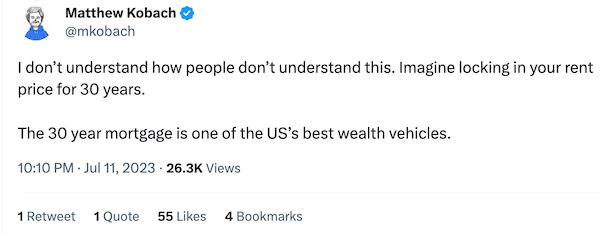

Marketing exec for the New York Stock Exchange, Matthew Kobach, also loves homeownership.

Screenshot by author

Owning a home is popular cause you can get access to fixed interest rates.

In Australia, where I live, we don’t have the same privilege. Most people are on variable interest rates because fixed rates carry a huge penalty.

So when interest rates go up we bleed from our eyeballs. Having fixed costs is a huge advantage though, especially if you’re American.

It’s also nice to own a property and give any children you might have a safe space to call home that they can rely on.

I bought my house for my baby daughter. This is where she will grow up and go to school. That’s an investment that matters more to me than buying some YOLO stock to get rich and buy a Lambo.

Renting is for those with high IQ

The advantage of renting is you don’t get stuck living in the same place for decades. You can travel. You can experience different cultures.

This is definitely a huge win for renters.

Homeowners often overlook the cost of owning, too. They forget about roof repairs, burst pipes, and the constant technological upgrades.

When you rent someone else pays for the repairs. Like I said, this assumes the landlord can afford to do them, or is willing to. Normally they are.

My little shack that I bought recently costs a fortune to maintain. It was built in 1975 and there’s a lot that has had to be done. I just swipe my debit card and pretend not to look at the costs LOL.

Savvy people often point out another overlooked point…

If you rent then you can use your money to invest in financial assets or a business you start.

Image credit: Cory Sylvester via a tweet reply

I can relate to this. By not owning a home I was able to invest much of my income into my business which has generated more than a 300% return.

Not everyone wants to own a business though. And 90% of small businesses fail in the first 5 years, so the risk is high.

When it comes to investing you don’t want all your money in one thing, like a piece of real estate or a particular stock.

You want a balanced portfolio.

For me, that means owning stocks, my online business, Bitcoin/Ethereum, real estate, gold, and a few ETFs like the Nasdaq.

That way, if 2008 happens again, I have some downside protection. And if the market goes to euphoria then I have money in tech and crypto to profit.

Renters have one up on owners though.

Every year property taxes and insurances go up. Many owners conveniently forget this. And property taxes can change at any time. For example, in Australia, we pay a one-off stamp duty tax but in the future the government wants to turn that into an annual subscription.

Owners have no control over how much property tax they pay. Renters do have control. If they don’t like their costs they can move countries or find a better landlord with a sweeter deal.

Economic expert Jared Brock reminded me that even if your real estate goes up by a lot, land tax of 1%-2% will take away your gains. Famous entrepreneur Michael Saylor agrees.

Owners also forget that they could one day be forced to sell.

You can’t predict it. Then you pay taxes and real estate agents to dispose of your home. That ain’t cheap. I paid $87,000 in tax to buy my home. My bank account had a sad face emoji on the day.

And to buy a home you need to come up with a huge downpayment. I had to find $400,000 to buy mine. As an example, most Americans only have $3,240 in savings. So the barrier to entry is out of reach.

Renting can be cheaper than a mortgage payment too.

Image credit- Andrew-#0i0d via a tweet

The cash you save can be deployed into financial markets for, historically, a much greater return.

What people get wrong about home investment

Now we get to the meat of both arguments.

There’s one big problem with all this money talk…

All of this is somewhat irrelevant though, as the decision to buy a home should not be primarily driven only by economics — pablorfraile

I agree. Thinking solely about money in everything you do is a form of financial mental illness.

The point of making good money is to be able to release yourself from the burden of always thinking about money.

Buying a home should be about more than money.

Owning a home gives you a feeling of freedom. You can customize a home you own to be however you want.

But if you want to be narrow-minded about homeownership then, yes, the point of being a landlord is to have the mortgage on your property mostly paid by someone else.

While someone else pays the repayments you get the capital growth on the land. Just remember that buildings depreciate in value and land generally appreciates.

Owning real estate also gives you access to leverage. You put down a 20% deposit and get to control an asset worth 80% more than that (5x leverage).

This level of leverage is decent and much less risky than leverage you could get with financial assets like stocks or crypto. The other part to home prices most don’t understand is supply.

In places like Australia and the US there aren’t enough homes.

This creates scarcity which causes home prices to rise more than they otherwise would. People also forget about immigration.

In Australia we have record immigration and not enough new homes being built. So home prices skyrocket and those that own them get an unfair advantage.

There’s one other trend I rarely see anyone talking about…

Corporations are buying up homes. Airbnb started the trend. Blackrock continued it. Make no mistake … in the future companies will own homes and real estate will become even more of a business.

Corporations don’t have the same limited access to money that the average person has. And they will bid up home prices just to make a profit.

As more banks and hedge funds enter the residential real estate market, prices will likely go even higher.

The bottom line ( controversial)

Let me end where most aren’t willing to go. Ready?

Homes shouldn’t be investment vehicles.

As finance guru Jack Raines says, “Homes should be depreciating assets much like cars, not investment vehicles.”

Homes are for living, not building wealth.

There are others who are catching on. The OpenAI CEO agrees:

Trying to make the price of housing go up over time instead of down is one of the most destructive policies I can imagine, and makes ~everything worse. So many things would get better if we could get this one thing right. — Sam Altman

And PhD physicist Casey Handmer has a similar take:

Image credit-Casey Handmer via a tweet

The money we waste on real estate would be better spent investing in humanity’s real problems. That’s what pisses me off.

There are many quotes from world leaders that say some version of the strength of a society is built upon the access average people have to own homes.

Right now home affordability is out of reach for most. It’s getting worse.

That’s the real issue. That’s what we should focus on, not on whether renting or owning is better. Homes make people feel safe and wealthy.

This article is for informational purposes only, it should not be considered financial, tax or legal advice. Consult a financial professional before making any major financial decisions.