Retiring early is taboo.

It sounds like privilege. But I didn’t retire at 34 with a huge chunk of cash and a mansion in L.A. I retired modestly.

While most people retire to stop working forever, I retired to stop doing work I didn’t give an F about. Huge difference.

Humans love to learn. Some people study history, but I studied money so I could have enough cash to buy back my time and study history. If I didn’t study money, I don’t think I ever would’ve retired.

I would have stayed comfortable in my minimum-wage job and let inflation destroy my purchasing power. But thankfully I made the right choice.

I started by studying books like these:

- One Up on Wall Street

- Beating the Street

- Rich Dad Poor Dad

- Money Master the Game

- I Will Teach You to Be Rich

- Think and Grow Rich

- Millionaire Fastlane

I later progressed to learning about money through high-net-worth banking customers at my job, and academies like Real Vision Pro.

After 10+ years studying money, here are the simple lessons I’ve learned (that helped me retire from the corporate world at 34).

Money buys time which is better than buying luxury

To retire early I had to understand what game I was playing.

The default game is to earn money to buy things you think you need. Once you run out of income, you’re then talked into taking on debt. This might seem harmless.

Photographer Bill Cunningham makes a good point:

“If you don’t take the money, they can’t tell you what to do.”

Debt allows more people to tell you what to do. If you want to make the repayments you must listen to them. They pull the strings. They decide if you get to keep paying the debt, and they know it.

When you think about early retirement in this way, taking on debt and buying luxuries makes no sense. It takes you further away from the real goal. So the game is to use money to buy time.

What that means is you use money to store time. Practically that means storing the money you earn in assets.

The next level of the game is to have money make you more money by buying assets that have an income stream. Once you understand this concept at a high level, the way you spend money will change.

Buying luxury stuff that declines in value as it ages makes zero sense. Spending money to look good feels stupid too. Once I adopted this strategy I started driving a crappy car, eating at home, wearing old clothes, and not giving an F what people thought of me.

Time to do whatever you want is the real goal. It’s easy to forget.

Everyone has to learn the pain of real tax firsthand

Tax seems okay when you have a job.

You don’t notice it because tax is taken out automatically so you never see the impact. When you start investing, owning a business, or getting paid from a side hustle your views on tax change.

A couple of years back I had a big year writing. I got a bill from the government for $500,000 in tax.

It nearly wiped me out.

I immediately went into panic mode and hired a decent accountant and set up new tax-efficient companies. My friend Jack Raines had the same problem. He started a newsletter and it gained traction fast.

The money he earned in his personal name piled up quickly. Before long he, too, got a massive tax bill. He’d spent all the earnings and had nothing left to pay the tax bill.

When you make money tax becomes a problem.

There are legal ways to be more tax-efficient without cheating anyone. Learn about them as soon as you can, so you don’t get a $500k tax bill with 30 days to pay like me.

You can earn a living doing the cheeky thing you think won’t make money

Many of us have our job and then the free hobby we love to do on the side.

We’re told selling our art isn’t worth anything. To stop dreaming. To stop thinking dog walking can make us a full-time income. This is when our dreams die.

I’ve learned from studying money that people can make cash from the weirdest things. The internet has made it even easier.

There are two parts to the game:

- Seeing people turn their art into an income

- Trying to do it yourself after hours

I was always told writing is a poor man’s game. That no one ever made money. But I loved it so much I kept doing it and proved them all wrong.

Why not you?

A subtle psychological shift that’s easily missed

The average person is taught to minimize costs.

They ask for discounts. They negotiate. They are thrifty and miss out on simple pleasures.

There’s a second type of person who’s less focused on cost and more focused on value and ROI. They understand the solution to money challenges is to make more money.

So they learn new skills, get around new people, and find ways to add extra income streams. You want to be the second person.

Complaining about the cost of something is the lowest IQ thing you can do. It’s the rat race game times a million.

Working for free is a smart move (and most will protest)

Yesterday I listened to a podcast with Noah Kagan & Tim Ferriss. They were both reflecting on their financial success and one weird thing stood out.

They both got life-changing opportunities by working for free. When Tim began doing startup investing, he’d beg to invest in a company, maybe put in $2000, then do free work for them as if he were the CEO.

Founders, advisors, and VCs noticed Tim. So he got invited to more private deals and that led him to the millions he made from companies like Uber and Shopify. Noah had similar stories.

Every one of his lucky breaks came from spending an unreasonable amount of time on a free project to get attention from the right people.

The same happened with me as a writer. I wrote for 5 years and never made a dollar from it. Friends called me stupid.

The “life ain’t fair” and “we want a raise” crowds hate when I say this. They think free work is slave labor. It’s not. Free work is how you grow your network and learn the skills needed to retire early.

Don’t ignore risks

A lot of studying money is understanding risk. It’s understanding everything has risk.

What we’re looking for isn’t zero risk. No. It’s calculated risks where the upside is bigger than the downside.

To get to this happy place, you have to learn about risk and decide how much risk in each area of life you’re willing to take.

These things amplify existing risk:

- Leverage/debt

- Overconfidence

- A big ego

- Short term wins

- Impatience

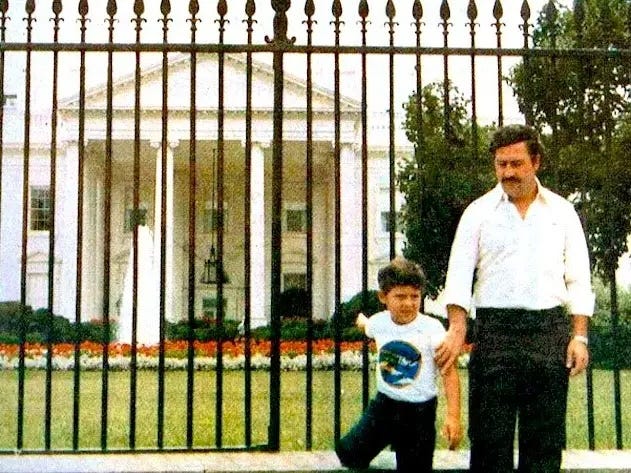

A great example is Colombian drug lord Pablo Escobar. His business was smuggling cocaine into America. It made him rich. The US government got sick of him getting away with his crimes.

The government offered $3.4M to anyone who had information on Pablo. During this same time he came to Washington with his son and took a photo outside of the White House.

Image credit-HistoryDefined.net

This is what ego and overconfidence can do. And it makes you take stupid risks that bankrupt you.

These things minimize your risk:

- Proof of work

- Social proof

- Humility

- A network that trusts you

Know there’s risk. The more risk, the greater the returns. The greater the returns, the more likely the risk will bankrupt you.

An accidental selfish approach ruins most people’s fortunes before they’re made

When people think of starting a business or growing on social media, I’ve noticed they always start with what’s in it for me?

This seems smart. We’ve gotta get paid, right? By focusing on themselves they end up paywalling everything they do. Even a “hi” requires a Stripe payment to have the privilege. Sad.

The selfish approach to money gets you nowhere. The better approach is to start with what do I have to give? And how can I give more than anyone else?

A coaching client of mine sent me their LinkedIn profile to review.

“Nothing’s working, damn it!”

Every post was a link to his new book. I’m not joking. That’s it for 6 months. And he did this 3–4 times a day.

Another guy I know, Eric, went from 0–1000,000 followers on LinkedIn in 6 months. He shares templates, cheat sheets, lessons, books to read, etc. People can’t get enough. Now he runs a 7-figure leadership business.

Those who give more get paid more. It’s counterintuitive.

The “end of America” crowd always stays broke

In the stock market there are bulls and bears.

Bulls are optimistic and believe the markets will go up in price. Bears are pessimistic and think prices are too high and will crash.

Some people are permanent bears. That is, they always believe the following:

- “A recession is here just you wait”

- “The US dollar will collapse”

- “All empires crumble eventually”

- “The election is gonna tank markets”

- “Facebook is overvalued and will crash”

These narratives are juicy. They’re addictive. And if you accidentally join this crowd I can guarantee you never retire early.

Focus on the long term and do your own research. It’ll help you avoid 99% of investing problems.

Passive income is the holy grail and it starts here

Passive income is money earned while you sleep.

It’s the one idea strangers on the internet hate because it sounds too good to be true. What’s missed is passive income is possible if you do active work to set it up — without it, it’s hard to retire early.

Passive income takes hard work too. You can’t just do 3 hours of work and have an Amazon FBA business make you $100k a month. If passive income were easy then we’d all have it.

So passive income starts with hard work. You have to choose the right vehicle that even has a passive option. I’ve found if you add systems to your income streams and know how to outsource, it speeds up the opportunity to go from active to passive income.

Final Thought

Retiring early is a paradox.

The obvious approach is often the one that doesn’t work. After I mastered the money game, there’s one truth from writer Genius Turner that hit me hard…and I’ll leave you with it.

“To truly feel rich, one merely has to add up everything money can’t buy.”

This article is for informational purposes only, it should not be considered financial, tax or legal advice. Consult a financial professional before making any major financial decisions.