Reframes act like money cheat codes.

Cognitive reframing, as it’s known, is how we view an area of our life through a frame. That frame determines your point of view. Research says “When that frame is shifted, the meaning changes, and thinking and behavior often shift along with it.”

People smarter than me reframed my basic ideas about money. Here are the best ones.

It’s hard to outearn bad spending

There are brilliant surgeons, lawyers, engineers who still don’t sleep well at night because they took their $300,000+ salary

Then bought a $900k home, $100k Porsche, $70k Tesla, and $400k beach home

Their income is now a slave to debt because it’s hard to outearn bad spending.

As much as I hate college it is required for people like doctors, lawyers, and engineers. Many of them end up making a lot of money because their skills are crucial for society to function.

A lot of them work extremely hard though. They never see their families. They rarely take holidays. It’s not that their job pays them poorly. It’s that they get addicted to spending. We talk a lot about social media or drug addiction, but we rarely talk about spending addiction that keeps people poor.

Author James Clear gives this advice: “Fix overspending before it becomes a lifestyle.”

Overspending forces your income to never rise. Therefore, you become a slave to your income. If you miss a few paychecks you can’t meet your expenses. That leads to a feeling of being trapped. And that’s how you become a debt slave. When you want to escape you can’t because the stuff you bought has gone down in value, making it impossible to recoup the money you spent and to remove the shackles of debt.

Cheat code: if your income increases, don’t spend more. Invest more in financial assets.

Buying assets is a means of survival

If your income is coming from labor rather than assets, you’re being decimated by hidden inflation — Naval Ravikant

People think I love stocks or crypto because I’m trying to be cool or look smart. That’s not it. The hidden inflation Naval talks about is asset inflation.

See, since March of 2020 40% of all US dollars in history were created out of thin air. This is called money printing. Most of you already understand this idea. If you don’t, it’s worth understanding it.

All of this excess money ends up in the financial system, mostly with the rich. The rich put that money into financial assets like stocks. That’s why the US stock market is at record highs after one of the worst events in history for the global economy.

There’s more to it. Many people don’t understand that when money is created out of thin air, most of it, first goes to banks. The banks then lend out that money. If $1 billion dollars is given out to the banks, they can lend out $900 million of it. The bank’s borrowers can then lend 90% of that. So $1 billion becomes $10 billion of debt.

The point: bank loans also print money out of thin air. Many people don’t know this.

Cheat code: Own financial assets to avoid the effects of asset inflation.

The average investor has no access

It is bad for society that it’s easier to invest millions of dollars into an NFT than a startup. — Sam Altman, Y-Combinator

Many people do not understand the urgency to fix our financial system. They think slow transfers of money from one side of the world to another, and 31% of the global population without a bank account is okay. You only think that’s okay if you’re a privileged white dude. Otherwise you see urgency.

What crypto did is made it easy for anybody to invest money in anything they want. Sam’s right: it’s easier to buy an NFT than purchase Amazon stock.

Right now the general public can only invest in businesses listed on the stock exchange. But most of the gains rich people get access to come from startup and medium-sized businesses. To access those opportunities you need to be an accredited investor.

An accredited investor in the US, as an example, needs a net-worth of more than $1 million. They’re not smarter. They don’t have an educational certificate in financial markets. No. They’re rich. Maybe it was via an inheritance or maybe they got rich at Las Vegas. Doesn’t matter. Only rich people can invest in the real investment opportunities.

The point of crypto isn’t to replace money. It’s to allow anybody in the world to invest into whatever startup or project they want to. The current financial system is racist. That’s the revolution that is missed by the crypto skeptics.

Cheat code: crypto doesn’t deny access based on your net-worth or race. Now you know why everybody is flocking there. Not to be cool … to be included.

Marriage makes you twice as rich

Boyfriend makes $63,000 and girlfriend makes $54,000.

Together (married) they make $117,000.

As individuals, they were average income earners.

As a unit, they became a thriving 6-figure income household.

Don’t jump the gun, but marriage is one of wealths cheat codes.

— @thewealthdad

Over the years, I’ve taught my soon-to-be wife everything I know about money and investing after working in finance. She has used the knowledge to copy most of my investment portfolio. As a result she’s made more money from investing than her job.

The lesson isn’t to get married to make more money. It’s to work with your significant other (if you have one) to learn together about how money works, so you can combine your income and become twice as better off. My partner and I aligned our beliefs about money early on. We agreed on how we would invest. We update each other weekly on our strategy. You can do the same.

Cheat code: The Barefoot Investor with over 400k subscribers to his email list suggests a monthly Barefoot date night. Both of you get together for a date to talk about money and how your investments are tracking.

The biggest hidden risk with money

“Investing is risky.”

These are also risky:

-One 9-5 job

-No growing assets

-No passive income sources

— @ FSFmoney

I read all the time that side hustles are stupid. Or that earning money online is a scam. These people tell me a job is the safest option for most people which is a blue pill. The red pill I give them is that relying on a job to survive is the biggest financial risk you can take.

Look at March 2020. As soon as a mystery illness broke out all over the world, companies started laying off employees. The corporation had to survive. The workers didn’t matter because they were replaceable.

Diversification is how you manage risk. You don’t only diversify what investments you make, but you also must diversify where your income comes from. Otherwise you’re highly likely to be royally screwed.

Business cares about profits, not about you.

Cheat code: createmultiple sources of income, that you use to invest in multiple types of assets, that earn money while you sleep.

Money is designed to transfer wealth from the poor to the rich

This isn’t a claim I make, because I’m not smart enough. This idea comes from Dan Tapiero, Mark Yusko, and Dan Morehead. They are three of the most successful investors of all time.

At a recent summit in New York they openly talked about how the current product we call money takes wealth from the poor and gives it to the rich. They explain that the math of how it works isn’t understood.

They mention how the inflation rate is clearly wrong and how rich people get access to money that they use to take assets off the poor. And how the rich get special access and can borrow limitless amounts of money, often, risk-free.

Nowhere in the presentation do any of them try to hide it. It’s as if the idea is taught to all hedge fund managers, bankers, family offices, and the rest of Wall Street as part of their initiation. Financial inequality used to be taboo years ago. In 2008 it was kept from mainstream media. Now you can hear about it on regular tv shows like 60 Minutes.

Cheat code: get a financial education as soon as you can. You spend your entire life earning money, may as well learn how it works. Otherwise you’re always swimming against the financial current and never get anywhere.

The real money cheat code

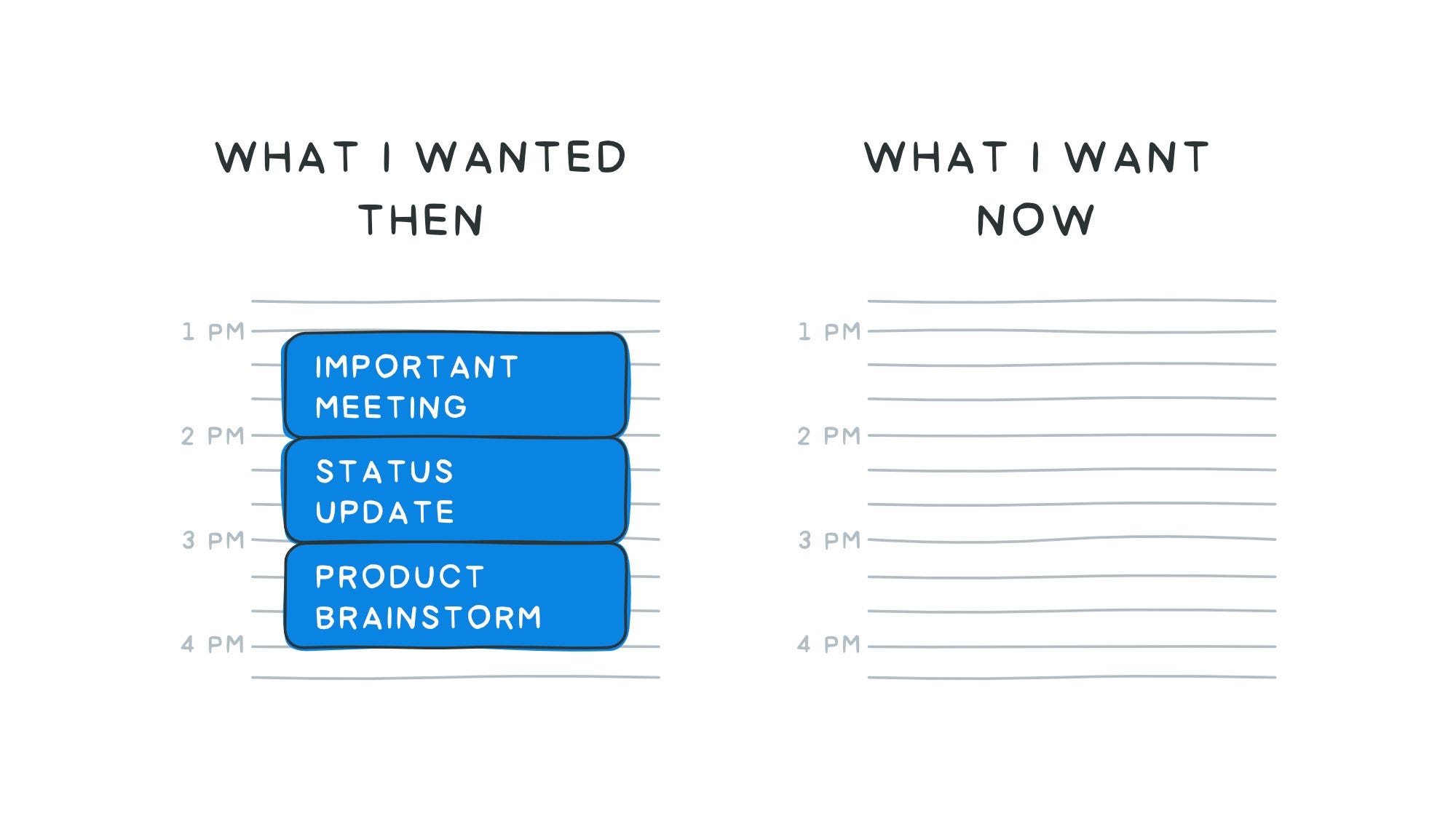

Aspirations in my 20s vs. 30s — Janis Ozolins

Janis is smart and nails it. Money is no longer cool.

Wealth is measured by your calendar. The more bullsh*t you have jammed-packed in your calendar, the less wealthy you are. It’s called time wealth. I call people like Janis “time billionaires.”

Aspire to spend your time how you want, doing whatever you want. Forget the luxury life that leads to broken dreams that keep you shacked to debt.

Takeaway

I learned that people smarter than me have the cheat codes to money because they spend the time to understand the global financial system.

They then understand what the Web 3.0 revolution is really trying to do. They look beyond the hype of crypto and NFTs to see a different world structure that’s permissionless and automates trust. There’s a lesson in there for you.

This article is for informational purposes only, it should not be considered financial, tax or legal advice. Consult a financial professional before making any major financial decisions.

Join my email list with 50K+ people for more helpful insights.