A polar bear can change your life.

Last week I saw one up close. 1146 pounds of fur. At first, he was a snoozer. Zero interest in earning his Seaworld paycheck. I was ready to leave and fed up with his sleepy behavior. Then the zookeeper arrived…

Nelson the polar bear came to life.

He jumped off from the top of a man-made mountain straight into the icy cold water at the bottom. It’s like nothing I’ve ever seen.

Majestic. Otherworldly.

Today is the same. While scrolling Youtube I stumbled across a weird video. A young Mexican boy is at a Coldplay concert. His dream is to be a musician, although autism holds him back.

His dad films them going to the Coldplay concert and singing to the songs. Then the famous “Fix You” song blasts out of the speakers. The little boy begins to cry.

His dad whispers “I love you, son” into the boy’s ear.

The crying becomes more full-on. It goes from nice to overwhelmingly emotional. The emotion hits his father as well. His dad begins to cry uncontrollably to the Coldplay song, too, as they watch the band perform.

What does a Polar Bear and a boy at a Coldplay concert have in common?

They teach us that experiences are what we should chase in life before it’s too late, rather than material possessions bought with money.

Here are a few more important money lessons that’ll wake you up with a roar.

Flaunting money covers up insecurities

I could walk into a Lambo dealership and buy one today.

Yet I don’t.

My home is under a major flight path, surrounded by factories, government housing, and loud trucks. My bank account says one thing, but my financial choices say another.

Writer Ayodeji Awosika says the desire to look wealthy comes from insecurity. Instead of solving life problems, far too many of us chase fame and riches to cover them up and feel good about ourselves.

The paradox of wealth

Money lessons from famous gurus are exhausting. Let’s learn from someone you probably don’t know.

Cait Mack left a killer comment on a story the other day.

She says that the wealthiest people aren’t working for money. They’re working because they LOVE working. The money they make is the result of loving their work. Seriously, wow. That’s how I feel.

Work you love is true wealth.

The reason we get paid is completely misunderstood

Working hard is an overdone p*rno too many of us have watched.

Entrepreneur Marcus Tan says we don’t get paid for how hard we work. Nope.

We get paid to solve problems.

When you become a problem-solver your financial future starts to grow exponentially. When you solve problems for one person or employer, you take home okay money.

When you take those same problem-solving skills and demonstrate them online through content, you add the magic of leverage.

Same amount of effort to deploy the skill, ten times the amount of financial upside. One-to-one, or one-to-many. Choice is yours.

Salary increases are a huge letdown

Getting more cash at a job is a bear trap.

If your salary goes up, would the number of problems you have to deal with go down? Nope. So there’s no point chasing an endlessly higher salary.

What you’re seeking is less problems, not more money. Do work you love, start a side hustle, and value your time better and your problems will magically decrease while your happiness will increase. That’s what is missed.

There’s another way to get time wealthy if you don’t own financial assets

One thing is missed about investing: many people can barely afford their bills, let alone have extra cash to buy stocks, crypto, or real estate.

It’s a fair judgment. There’s another way.

If you have no financial assets, create digital assets. Then use the money from digital assets to invest.

Digital assets are:

- eBooks

- courses

- websites

- newsletters

- eCommerce

- online communities

We never learn from recessions

In 2008, the housing market blew up and created a meltdown in global financial markets.

What caused the crisis was Collateralized Debt Obligations.

I won’t bore you with the tech talk. This CDO financial tool brought the house of cards down. You’d think more than 12 years later that CDOs would be extinct, given the widely reported damage they did. Not quite.

Some smart guy on Wall Street simply did a name change. They’re now called Bespoke Tranche Opportunities.

If there’s one thing you must know about money before it’s too late, it’s that the same causes of recessions will keep happening. Why?

Greed makes it too difficult to make the financial system honest.

The key to unlock effortless amounts of money

I preach the importance of side hustles and making money online.

Many good-intentioned people follow the advice and start their own tiny, online empire.

And they fail miserably.

It’s taken me a long time to figure out why. Here goes: to make money online you have to pass an invisible threshold. It’s where you’ve created more value than you seek to get back.

Way too many people do it the wrong way.

They start some online side hustle and then, tomorrow, they seek to extract maximum value upfront and paywall slap every potential human that might be interested in what they have to offer.

Stupid.

I accidentally did it the right way. I spent years writing online and helping people without ever asking for a dollar. When I did start to make money, I held on tightly to the philosophy of “let 99% of people get access for free.”

Stop paywall slapping strangers. Extract less value than you give.

The cost of stuff is an illusion that’s 1000s of years old

Everything you want to spend money on is measured in your country’s currency.

The trouble is the total amount of that currency in existence can be changed by your country’s government. So the rise and fall of prices is near-impossible to measure.

Remember this next time you hear someone say “my house went up in price 25% over the last year.”

If the total amount of money in existence is rising every year then did prices really go up?

“A lot of financial debates are just people with different time horizons talking over each other”

This fact explains crypto and NFTs. Many people are highly skeptical of them. It’s not that one side is wrong and the other is right. It’s that one side believes crypto/NFTs will be mainstream in the next year.

The other side is skeptical because time hasn’t worked its magic yet to create enough traction.

The same happened with the internet. Those with short timeframes got destroyed in the dot com bubble. Those with long time frames made fortunes out of the tech boom of Google, Facebook, Apple, Amazon, etc.

Think long-term to see financial opportunities become wealth accelerators.

The new status symbol bankrupting Gucci

Lady Gaga was great in that Gucci movie. But do we want to make that idiot family more money by buying their overpriced crap? No way.

Thankfully, we don’t have to decide. The latest status symbol that’s more popular than any luxury leather bag is freedom.

- Time freedom

- Location freedom

- Financial freedom

Being able to do whatever you want, whenever you want, however you want, without being a wage slave is the ultimate form of financial success.

The great news is it’s not hard to do once you implement this next lesson…

Become richer by needing less

The freedom to do whatever you want is easier to achieve when you become fine with needing less.

Every dollar you spend steals a part of your freedom. Every dollar of debt you take on compounds the loss of your freedom.

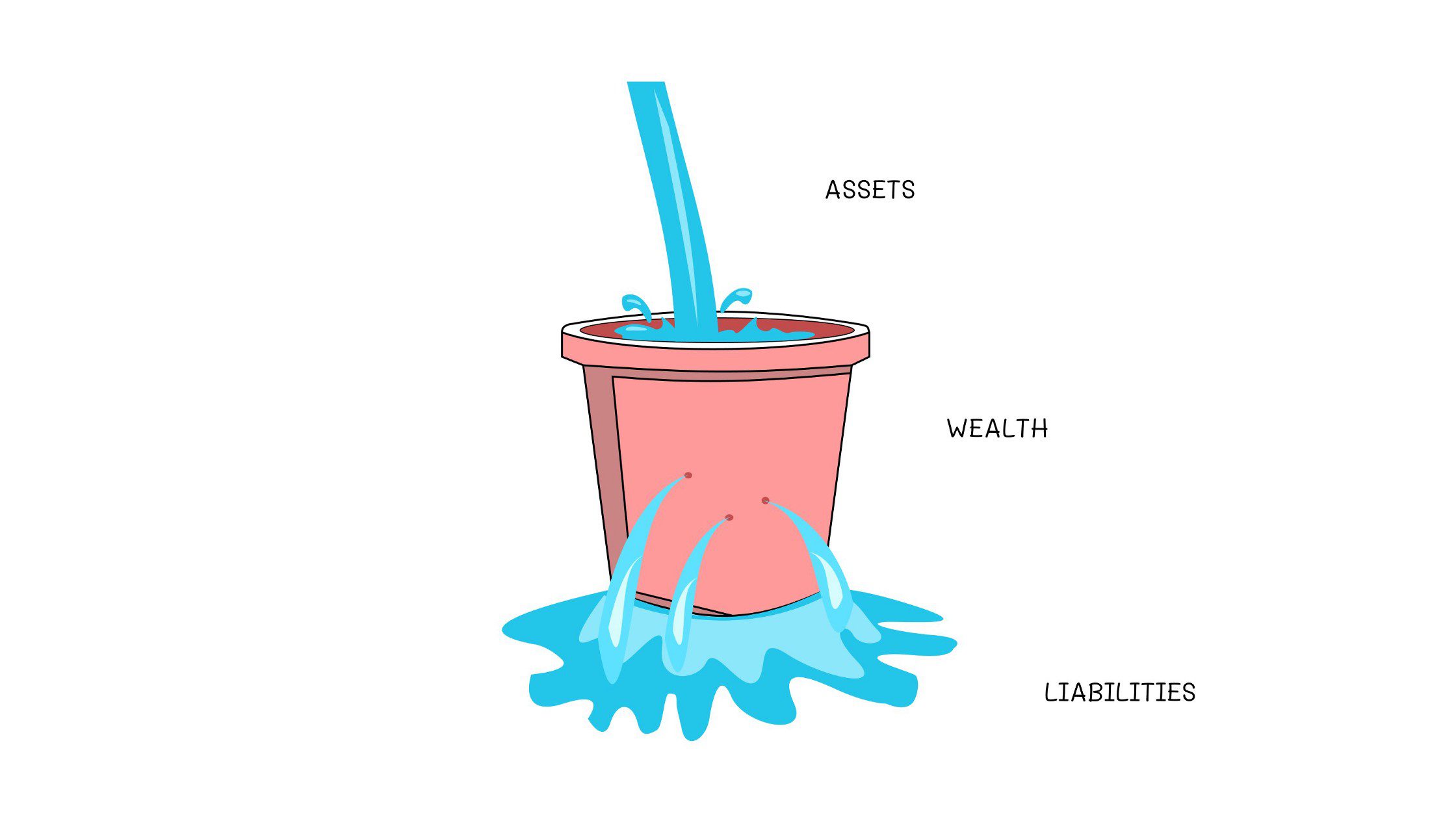

Once you see this visually it’ll change your reality. Money guy Felix Hazlehurst says all you need to do is fill the pink wealth bucket in this image below.

Image credit: Felix Hazlehurst via Twitter

The only way to be trapped financially is to let ads keep telling you about problems that aren’t really problems. Being stupidly content can help too.

Once you understand this lesson the path to true wealth is fast-tracked.

Wealth buys freedom, and freedom buys happiness

Being cash poor is an enormous victory

I have no cash.

I literally can barely pay my tax bill. All my money is tied up in investments — mostly, stocks and crypto. As soon as I get paid the bulk of it gets invested. Without much cash, I don’t have much to spend.

Temptations are hard to buy when your bank account is zero. And when your money is mostly in investments, the friction to sell those assets and convert them to cash is too high to go through with.

The best life hack is a lack of cash.

This article is for informational purposes only, it should not be considered financial, tax or legal advice. Consult a financial professional before making any major financial decisions.