Handing back my access card always makes me cry.

That’s the last task you do before you leave a job. When I quit working at one bank, the waterfalls burst out of my eyes.

I learned to love finance after being skeptical of the industry at the start. I learned the secrets of the finance world while working in banking and managing some of the largest companies in the world.

Here are a few wisdom bombs that will slap you silly.

Finance is a religion greater than Jesus

“It’s a faith based system.”

That’s what former president and CEO of the Federal Reserve Bank of Kansas, in the US, Thomas Hoenig, said about our global financial system. I agree.

The US dollar used to be redeemable for gold. Now it’s not backed by anything. You have to have blind faith in government that a currency is worth something.

One day that faith will be tested.

You don’t own your money

When you deposit money into a bank account it’s no longer yours.

This scares the crap out of people when I tell them. Read the product disclosure statement of whatever bank account you hold. It’s written in black and white.

This technicality normally doesn’t matter…

Until a 2008 style recession hits.

Back then we saw the big US banks get bailed out by the government using money created out of thin air.

It led to mass protests known as Occupy Wall Street. The government can’t do that again. The people have wised up. So there’s another silent tool.

Bail-ins.

We saw this during the Greece financial crisis.

If sh*t hits the fan and the financial system has a heart attack, the money in your bank account isn’t safe.

The bank can use your money to cover their debts. In the event of a bank collapse you are a creditor. Get in line! as they say.

Some will point to government guarantees on bank deposits.

LOL.

If a bad recession hits no government has enough free cash to bail out every bank. What normally happens, according to history, is that if your bank goes down you won’t lose every dollar. Your savings will get a haircut though.

The government may cover some of your losses. The bank may cover some more. But there are no guarantees.

Finance guru Steve Burns dumbs down reality into one sentence:

The money in your bank savings account is their investment fund not yours.

The bank invests the money you give them.

In good times, they get rich off your money. In bad times, if those investments fail, you cover all — or some — of the bill.

Lending money for innovation isn’t what banks do

A happy-go-lucky farmer one day walked through our doors.

“Good day sirs. I’m looking to get a loan to buy drones to herd sheep.”

In a matter of minutes, one of my colleagues shut him down. He was trying to do something that hadn’t been done before.

There were wifi issues connecting sheep with tags to communication towers that beamed the info back to a computer.

We told him, “you’re dreaming mate.”

It makes me sad. Traditional finance is designed to protect the status quo. It’s why most tech companies are funded by VCs, not banks. The hardest part is when a customer gets rejected for a loan. They get really deflated.

It’s the banker’s job to talk people out of their dreams.

Why?

To save time.

Bankers have to move fast so they can get bonuses. They don’t have time for sob stories or to care about your fantasies of starting a business. Churn and burn. Look for proven business models. Tell everybody else it’s too hard.

I told one Bitcoin business early in my career that their stupid currency would never take off and to go jump in the lake. Now they’re a household name and both founders drive Lambos.

I was a fool but learned the hard way to change my ways. It’s why I had to change career.

The finance industry doesn’t get innovation. It doesn’t pay enough to understand — too much easy money to be made.

The prison walls of institutions keep us trapped

The finance industry is built on institutions.

The Shirky Principle explains why they’ve created hidden problems for us.

Institutions will try to preserve the problem to which they are the solution.

It’s the best way to ensure their survival and growth. Examples include planned obsolescence and the various “industrial complexes” (military, prison, pharmaceutical, etc).

That’s why Wall Street doesn’t change its greedy ways.

We rely on them too much. It’s why we bail out the jerks in suits and let them have their way with high-class hookers.

My career taught me that this will change.

I don’t know how yet. I suspect Defi (decentralized finance) will start the fracturing of the Berlin Wall we call Wall Street.

Bottom line

Institutions and institutionalized humans are the problem. They make progress and fairness unprofitable, so they cleverly cancel it.

Disruptors will 100% destroy banks

Tried to change the address on my bank account today.

Took me over an hour to find the answer. I have to print a form out and fax it back to the bank. They then take 10 business days to action it. What a joke.

Banks are about themselves, not the customer.

I’ll get shot in the butt cheek for saying that but it’s true. Future banks will be tech companies.

Google and Apple have already steamrolled their businesses into banking territory. The silent slap to the face for banks will be blockchain.

Only a matter of time.

All you are is a risk calculation

Behind the scenes of finance is a lot of talk about risk.

It’s the industry’s number one concern. What happens if you can’t cough up the cashola? That’s what they care about. So, they have risk models where they input data.

If the model says there’s a chance you can’t pay back a debt, they’ll exit the room faster than Ricky Gervais after hosting the Oscars.

The finance industry back sure bets. They charge you a risk premium, but really, their risk is near zero in most cases.

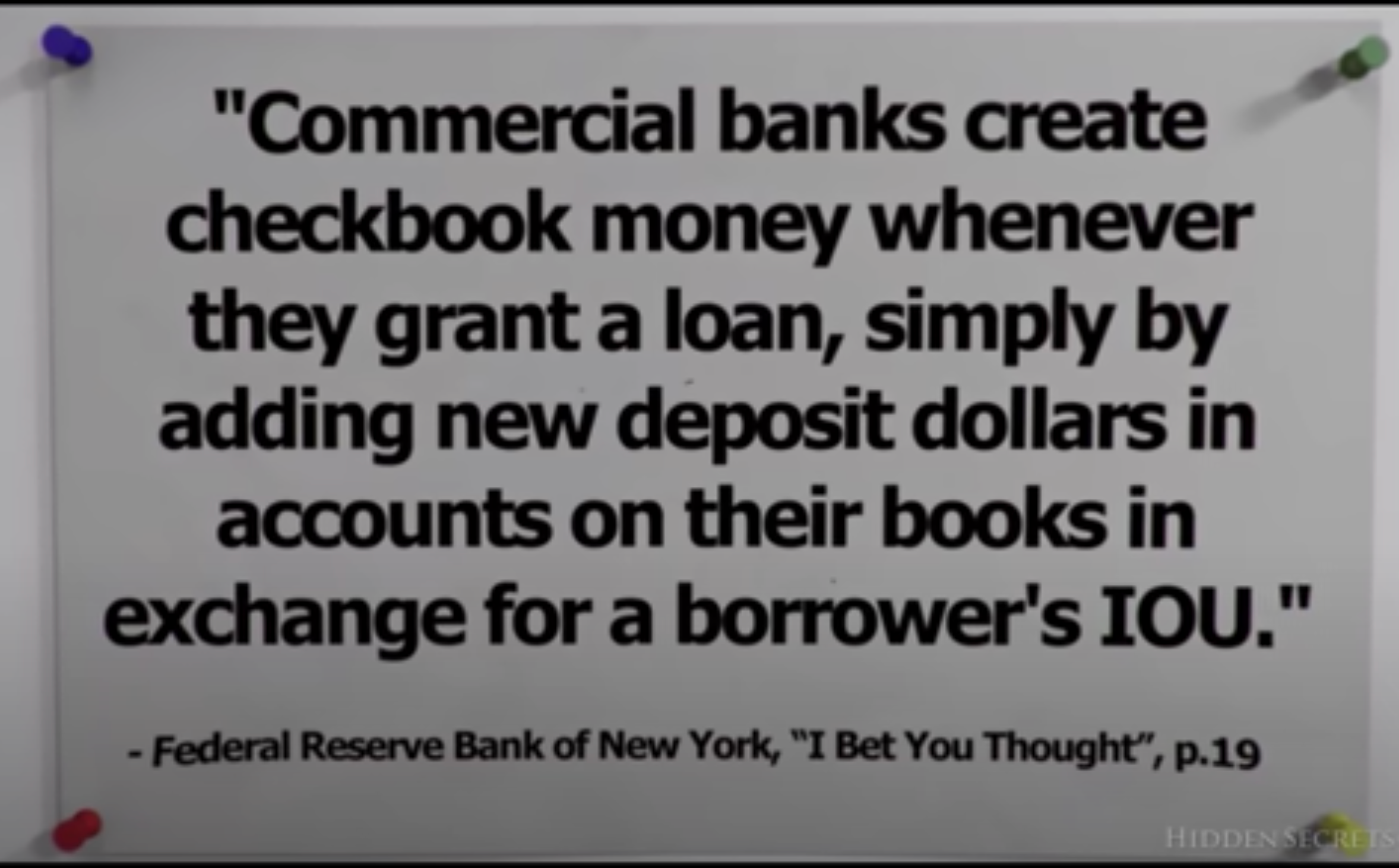

Every loan given creates money out of thin air

Fractional reserve banking is one of the greatest scams of the 21st century. With a tiny amount of money in their account a bank can lend against it.

Every loan a bank makes creates money from nothing.

Checkbook money is BS money created from nothing by bank computers. The more money the banks create through lending out money, the higher prices rise — and the faster it happens.

You’ll never look at money the same way again once you see how it gets created.

Watch the full video on how it works here (take the dramatization with a grain of salt. Some of it is hyperbole).

Closing Thought

Learning about money was a blast. Once you understand money, you understand greed. Greed explains the state of the world.

Get a basic financial education to survive post-coroni-macaroni times.

This article is for informational purposes only, it should not be considered financial, tax or legal advice. Consult a financial professional before making any major financial decisions.