There are angels with halos who say they don’t care about money.

Nonsense. Makes me laugh.

I don’t consider myself money-driven either. But that doesn’t mean money doesn’t matter. Anyone who tells you they don’t care about money is lying, especially if they work a job.

Next time you meet one of these god-like figures, ask them if they can divert all of their future income to your bank account. Watch what happens.

So we need money to live. Nice. Therefore, we better bloody well understand as much about it as we can since we trade most of our lives for it.

The rich don’t sell assets

Spoke to a writer friend recently. They sold 6-figures of tech stocks for a nice little gain. My face turned red. Now they have to pay capital gains tax. Based on their tax bracket the bill comes to 40%.

Nothing wrong with tax unless you pay it unnecessarily. The rich figured out a little trick. They do everything in their power never to sell good quality assets like real estate or solid companies they own stocks in. Nope.

The rich borrow against their assets.

A classic example is bitcoin. It’s one of the best-performing assets in history. It’s now an everyday part of our financial system (not even the US government disputes that anymore).

If you’ve done well from bitcoin you can sell it. Or you can lend out your bitcoin to people who want to trade it or use it to start a business (aka decentralized finance). When you hold on to your bitcoin, assuming you believe in it long-term, you continue to access the gains in price of the asset, and you earn interest from people you lend it out to.

You can also borrow money against your bitcoin to buy whatever you need in life — the same way real estate investors borrow against their properties to buy more, or tap into the equity in their home to pay for a car, holiday, kid’s college, etc.

Think deeply before you sell any asset.

The denominator of value changes everything

Ever been at a BBQ and had some Cracker Jack go “yeah mate, me property is up 20% this year and so is my portfolio of S&P 500 stocks.” These same weirdos say things like “I’m a millionaire.”

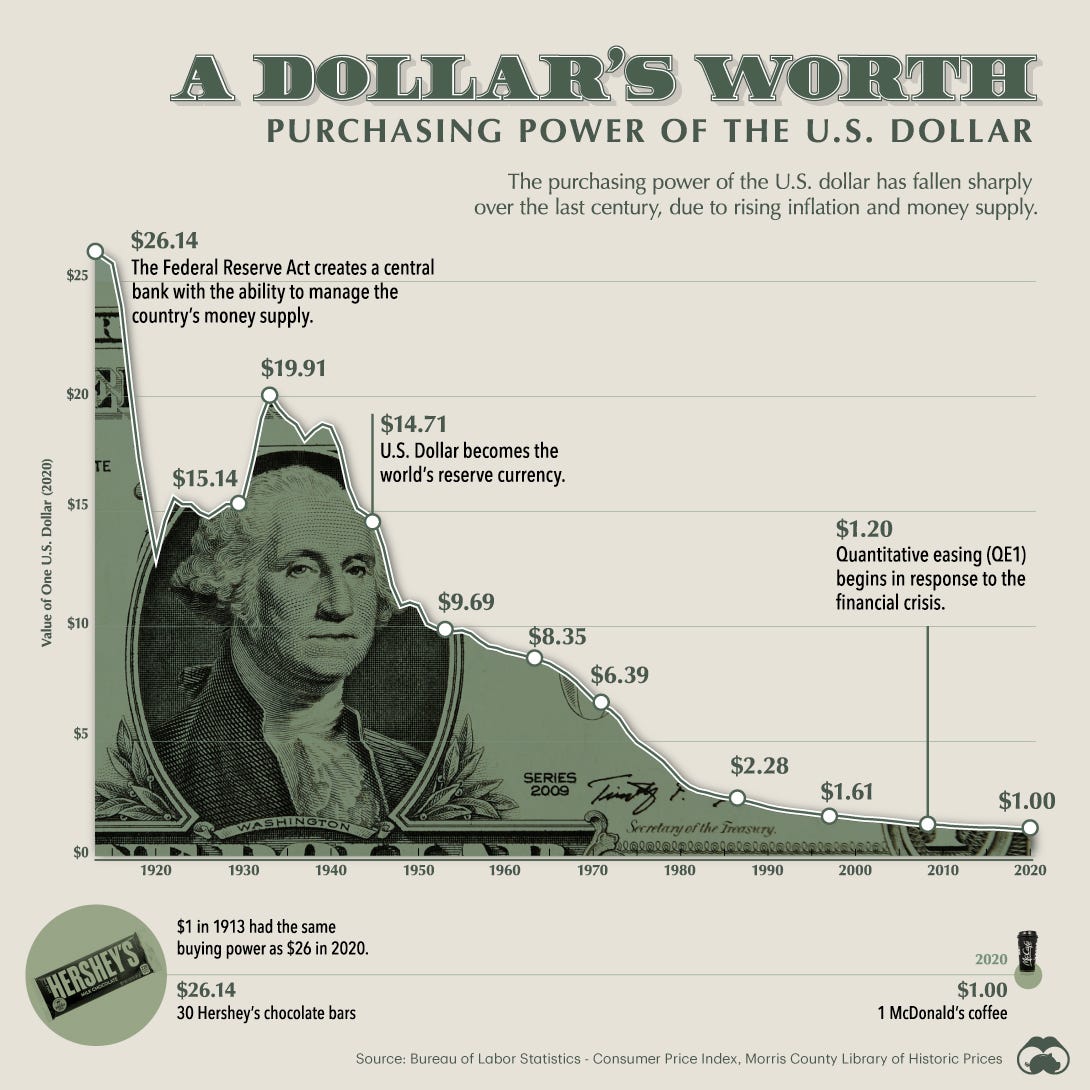

Everything is relative. A millionaire in 2021 isn’t the same as a millionaire in the early 2000s. This graph explains why and lights many dreams on fire. Sorry.

Finance expert Raoul Pal encourages us to change the denominator. Instead of measuring everything in dollars, try something else. The best example is US real estate. Raoul shows through his datasets that the median US citizen has lost 90% of their purchasing power when their income is measured against the median US property price since 1968.

Beware of the people that tell you how rich they got from stocks or real estate. If you measure value in US dollars then everything looks great and like it’s booming. If you change the way you measure value the truth is revealed, and the need for a financial education becomes an urgent survival skill.

Money is an ice cube that melts (by design), so you have to keep working to earn it without understanding why.

Brutal truth: you’re probably not getting financially richer. We need you to think you are though.

“I can’t make money” becomes a self-fulfilling prophecy

Wifi money is possible to get for anybody that wants it. The only barrier to entry is a little creativity. I read a story recently of a guy on Twitter. During lockdown his friend started baking cakes.

She didn’t dream of being the next Elon Musk. She quietly sold her cakes to family and friends for fun. One night over Twitter he told her to promote them via Facebook Ads. The idea sounded good to her, so she asked him to build her a website. He did.

18 months on she has two stores and 10 of her friends have become employees in her business. She used the profits to help retire her mother. Anyone can make money online. You may not become a billionaire, or quit your job because of the extra cash. But don’t you dare tell yourself it’s impossible.

What you tell yourself about money programs your financial future. Read that twice.

There’s only one simple solution to inflation

Let’s cut to the chase. You know that in countries like America they create money out of thin air, label it as stimulus, and give it out to people and businesses to pay for things like a global health crisis.

The cool kids call it money printing. The pinstripe suits call it quantitative easing that leads to inflation. Who cares, labels are useless. The only way to avoid having your purchasing power go down faster than a flat tire that’s gone over a packet full of nails is to take your life into your own hands and buy financial assets.

The hidden tax of inflation will easily defeat you without financial assets.

Your money can be easily lost

Naval Ravikant is a well-known entrepreneur. Many people don’t know his backstory. He lost his first fortune on the stock market. He lost his second fortune to his business partners that cheated him out of it. He got rich the third time with tech startups.

You can take away all of someone’s money. But you can’t take away the lessons they’ve learned. That knowledge is what helps them bounce back from anything, even bad luck.

Even if you go bankrupt, get cheated or an unfortunate financial disaster occurs, it doesn’t matter. Your skills and mindset are your money differentiator, not your ability to make money once.

“The way most fortunes are lost *is not* through excessive expenditure”

The co-founder of the iconic Y Combinator, Paul Graham said that. “Money is lost through bad investments.”

I’ve seen it many times. People make a bit of money then all of a sudden they think they’re a genius investor that can find great investments.

They end up putting money into a bunch of dud startups full of unicorn dreams, or buying stocks that go to zero, or getting caught up in the 10,000+ worthless cryptocurrencies like Dogecoin. Before you know it, they’ve lost all of the money they made from their successful pizza shop. They should have stayed making pizzas, yet their ego got the best of them.

Don’t invest based on hype or getting rich feelings. Learn from finance experts, do crazy amounts of research, and diversify in case you’re wrong.

What they secretly don’t tell you about investing

“What they tell you:

If you invested $100 in Apple’s IPO and and held shares until today, that investment would be worth about $100,000.

What they don’t tell you:

If you invested $100 in Apple’s IPO and held shares until today, you would’ve endured 23 declines of 20% or more.” — Callie Cox

Anybody can ride the highs of crypto or stocks and look like a legend. I’ve learned from my career in finance that it’s the declines that are scary.

In March 2020 everybody’s financial psychology was tested. Many people panicked. As hard as it was I bought stacks of bitcoin and ethereum. My friends and family thought I was nuts.

But my financial education taught me what comes after a catastrophe like 2020 or the 2008 recession: loads of money printing, followed by 0% rates on savings, and close to 0% interest on debt.

So it made sense to me to buy scarce, volatile assets that have strong network effects and upside growth that can beat inflation no matter how bad it gets. Right now inflation is above 5%. The part that is missed is assets that swing up and down in price a lot are frightening.

I used to be terrible at holding onto investments back in 2013. After so many years of 50%-80% drops in bitcoin and ethereum I’m used to it. I am no longer fearful because years of daily research remind me of what I bought and why.

Declines in asset prices are scary. The more you endure the better you get.

Ups and downs equal growth over the long term. That’s the final uncommon lesson about money that you work your entire life to earn.

This article is for informational purposes only, it should not be considered financial, tax or legal advice. Consult a financial professional before making any major financial decisions.

Join my email list with 50K+ people for more helpful insights.