Gambling is bad, m’kay.

That’s what we get taught. Obviously slot machines and Vegas casino trips lead to nightmare results. I’m not advocating you do any of that.

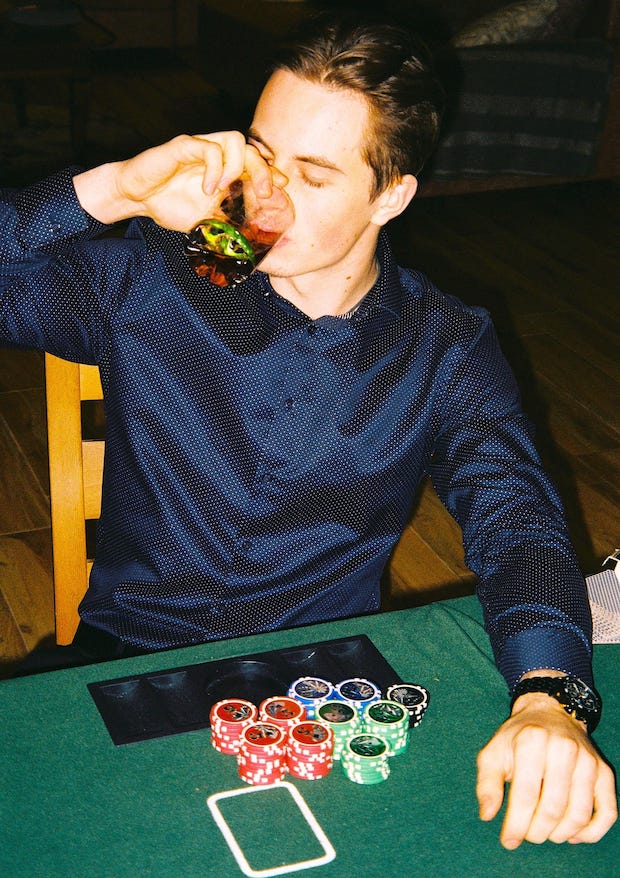

But there’s a new category of gamblers. I call them life gamblers.

They see risk as a necessary evil. They don’t run from risk like a schoolgirl running from a murderer. No. They add risk to add opportunities.

Here’s what they do.

We’re all gamblers

You might think you’re not a life gambler. You are.

Author James Clear states there are two types:

- The risk takers who gamble with the chance of failure.

- The risk adverse who avoid failure and rejection at all costs and stay comfortable. They gamble with the opportunities they could have got access to if they’d taken more risks.

The difference is courage. It’s easy to take zero risks.

The smart risk many of us refuse to take

Many of us stay in jobs we hate.

The energy and courage to move or try something new is too great. This is how I was in my finance career.

I knew I was wasting my life. I hated being told what to do. But I put up with it for a decade because I didn’t want to take a risk. I believed the lie that once I quit my job I could never go back.

My mind told me I’d become damaged goods.

Recruiters and hiring managers would get a secret corporate email that outlined my betrayal and then they’d shadow ban me from every good job in history.

Now, after the fact, these same recruiters and hiring managers tell me the opposite. They say quitting your job to chase some crazy dream shows courage, leadership and drive — all things in short supply that they’d kill to find in a job candidate.

While I did finally take the risk and it paid off, I can’t help but think I wasted many good years of my life being packed into a train like a corporate sardine instead of doing work I cared about.

You can’t go back. But the regrets from a lack of risk do carry forward.

Looking for strategies instead of doing the work

I meet people every day through my online business who want strategies.

This hard question stops them in their tracks: What have you tried?

It often reveals they’ve tried nothing. They’ve done learning as a form of entertainment but they haven’t backed it up with execution and risks, so they don’t know what works and what doesn’t.

They’re hoping someone like me can tell them for $20.

That’s not how it works. The real learning comes from taking risks. When they blow a giant hole in your life the lessons reach several layers deep into the mind, whereas Youtube videos of other people’s experiences only scratch the surface.

And because we’re drowning in this type of external education and experience, much of it barely makes an impact anymore.

It doesn’t move us to action because it’s all too familiar. So it makes us think we know everything when we actually know little.

The biggest risk is a lack of execution.

Taking no risks will end up being your biggest risk. If you’re always avoiding risk, you’re risking missing out on life — Steven Bartlett

Success takes a lot more than mediocre “hard work”

The corporate world loves to glorify hard work.

L-i-i-i-i-k-k-k-k-e-e-e-e that’ll make you successful LOL. Entrepreneur Justin Welsh says the difference between making $75K and $750K is betting on yourself.

If you don’t bet on yourself you become a bet in someone else’s business, where the returns on your investment are distributed broadly instead of only to you.

Taking a bet on yourself looks like putting yourself on the line.

Doing something you know could blow up in your face. Risking everything you’ve worked for to create an even better future for yourself. Speaking out of turn. Doing the hard thing you know you must do but have been too scared to do.

That strategy is way harder than hard work and it’s why the dividends are ten times greater.

What financial ruin taught me about risk

I lost a tonne of cash a while back.

Since the big loss I don’t play it safe with money anymore. You know why? Because financial ruin taught me that I can make it all back again.

Once that truth becomes your reality, you no longer hold onto your money as if it’s your dying mother.

A risk that blows up in your face can always steal your money, but it can’t steal what you learned to make the cash in the first place.

The most common accelerator of risk

I wish more people saw what added the most risk to their lives.

From what I’ve seen online for the last 9 years, a lot of risk comes from trying to get access to hacks or shortcuts.

This lack of patience misleads people to make bad decisions and apply unrealistic expectations to their goals. Once you add more patience into your life the risks reduce.

Opportunities look like risks

When I educate people about the opportunities online, far too many people respond in a skeptical way.

They leave smart ass replies. They say the online game is a scam.

The thing about new opportunities is they look like scams or risks in the moment. But when you look back at them they look like missed opportunities. There are risks in everything.

Learn to see through risks so you can also see opportunities.

The bizarre case for “going all in”

A lot of people live an index fund life.

An index fund is where you put money into a fund that distributes your investment across hundreds of companies. If any one company fails or its stock price crashes it doesn’t matter.

If a company in the fund does well you get some small upside.

The returns on index funds are mediocre. They take decades to get, if at all. Yet this is the path many people take in life.

They’d rather invest in the American S&P 500 and spread themselves across 500 companies than go all in on one opportunity they’ve researched and experimented with.

When you select lots of possible outcomes by hedging your bets, you protect yourself from losses, sure, but also the big wins.

The antidotes to too much risk

If you want to be a life gambler and get the rewards there are a few smart ways to limit the downside.

- Make more money so you have access to optionality in case a risk comes due.

- Have one or more side hustles. Test risks as side hustles before you decide to go all in on one.

- Build your network and earn people’s trust. That way, if everything goes south you can lean on your network to help you recover and find new opportunities.

- Focus on being humble. Because if you don’t, when the devil known as risk comes knocking at your door, you’ll be unprepared for the crap storm that follows. No matter how smart you are a risk can become a big failure. Never forget.

Final Thought

My only regret is not taking more risks. Lose the programming that tells you safety nets are a good idea and risk is to be avoided at all costs.

Comfort has ruined more lives than uncomfortable risks ever will.