One 56 year old lady said this to me today:

Learning new money skills is hard as you get older. Because a lot of the learning entails unlearning first…ingrained habits and mindsets that were formed over decades.

The same is true with money. The way to become wealthy is to go against common sense and UNLEARN all the bad money habits that are secretly robbing you and stealing the good life away from you.

Here are the worst invisible money habits to throw in the trash forever.

Bad Habit #1 — Free government benefits aren’t paid for by others

The welfare mentality is thriving.

People love getting stimulus and handouts from the government. They assume some other sucker is paying for it. They thank their president and bless the ground he walks on.

“What a good guy he is.”

93 year old economist Thomas Sowell regularly says things that blow up my mind. Here’s what he said about “free money.”

People who imagine that the benefits they receive “free” from government will be paid for by others may discover that they themselves end up paying for those benefits, as a result of inflation.

You may get free money but the increased cost of living eats away all the freebies. Inflation is a tax. Just in the last year the cost of living is up 20%. How? Because the inflation calculation you hear in the news is cumulative.

That inflation is how you are taxed again if you don’t own financial assets. It’s why the middle class is shrinking. The worst habit in history is relying on handouts.

Become self-sustaining instead. Become immune to inflation through investing.

Bad Habit #2 — Asking for discounts like you’re Mr Burns

Asking for discounts is a bad habit taught by modern money gurus like Dave Ramsay. They make you think it’s smart when it’s dumb.

I’ll give you an example. If I want to connect with someone, I buy one of their products or services at full price. Why?

- It gets their attention.

- It gives me the right to ask them a question and increases my chances of getting a response.

Asking for discounts is offensive.

It makes you sound like Mr Burns. It shows you don’t understand value or ROI. The real epidemic is asking for free advice/services & expecting it to help. Even worse is trying to barter services like a settler from 300 years ago.

Spending money is good. It gives you financial accountability so you’ll take action. And you’ll make some powerful friends in the process.

Bad Habit #3 — Quick wealth isn’t anti-fragile

Morgan Housel is the best money writer on the internet.

I read everything he writes as if he is the Virgin Mary. Let’s just say I’d have his babies (if you know what I mean).

He said something that I’m going to hang on my daughter’s playroom wall:

Quick wealth is fragile wealth.

Making money fast has its advantages for sure. But if you make money too quickly it becomes fragile. Your ego gets big. You start to think you’re a god and everything you touch turns into a gold Lambo, bro.

The speed in which you made your wealth is the halflife for how fast you can lose it.

Then Morgan rips the shirt off my back again with this one:

The quicker the wealth was made, the higher the odds it came from luck that will revert just as fast.

Some rich people are walking around as if they’re smart when really they got lucky and don’t realize it. Speed has a lot to do with it. I became a millionaire over a 9-year period, which is why I’m confident it wasn’t luck.

It was skill acquired over many years with daily actions and a healthy investing habit in the stock market.

Learn to see the difference between luck and fast wealth that’ll disappear in a recession.

Bad Habit #4 — Running from boredom

Society doesn’t want you to be bored. It’s dangerous. You may think too much and decide to go rogue and exit the Matrix.

My friend Dickie said “Your income is *directly* correlated to how much boring, monotonous work you are willing to put in for long periods of time.”

He’s right. Getting wealthy is a boring pursuit. There’s a lot of repetition and lessons you learn over and over. Most people don’t get wealthy because they want it to be fun and full of shiny objects.

That’s not how it’s been for me.

I wake up at 6 AM each day, which is earlier than I would like, and start work. I answer more emails than you could imagine. Yesterday I clocked up over 1000 replies. I’m not having fun with emails, but it’s part of the work.

Put your phone down and stop being entertained 24/7 by Youtube and podcasts. A lot can happen then.

You may just fall in love with boredom which is full of the type of repetition that’ll make you wealthy.

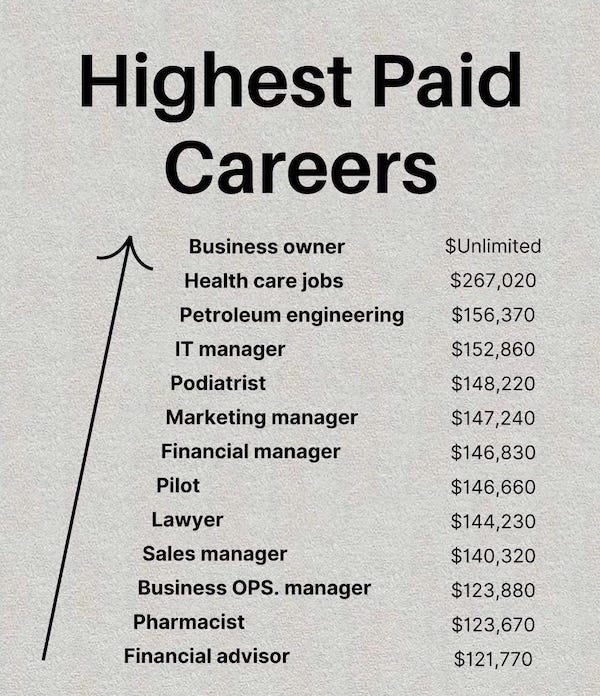

Bad Habit #5 — Thinking doctors, lawyers, and engineers have the highest-paid careers

My family constantly pisses me off.

They think if you’re not a college-educated doctor, lawyer, or engineer, you’ll never be wealthy. Fools.

College taught us to worship these professions.

- Unlearn their brainwashing.

- Disconnect from their marketing campaigns.

- Burn the idea of alumnus to the ground.

Here’s the truth…

Image credit-Lawrence King via X

If you want to get wealthy and own your future, a business is the best way. If you’re not a born natural at business, like me, you can start a one-person business with no employees which is far simpler and doesn’t need an MBA.

Bad Habit #6 — Selling to people with no money

This one isn’t designed to be harsh so put away your flare guns.

One of the biggest problems you can have as an employee or business owner is offering products/services to people with no money.

I found that when I sold to people who always wanted discounts, coupons, extra freebies, payment plans, etc it wasted a lot of my time. So I stopped doing it.

My income exploded.

I focused my time on the people who could pay for what I do and saw value in it. There are only so many hours in the day. Stop wasting them on tire kickers and people who’ll take the shirt off your back if they can.

Lesson: Sell the same thing but to wealthier people.

Bad Habit #7 — Spending time to save money

You don’t get rich by spending your time to save money. You get rich by saving your time to make money — Naval Ravikant

The sticker price is a distraction.

Saving money doesn’t make you wealthy. Making more money does. So that’s where your time should be focused.

It feels weird to say because it can seem illogical from afar. Again, society and consumerism have taught us to obsess over prices and discounts. Most discounts are bullsh*t anyway. I’m sure you know that.

Focus on making more money. How? 1) Self-education 2) Learning high-income skills.

Bad Habit #8 — Running from anxiety

Many people want to get wealthy so they can be less stressed or overcome anxiety. Yes, a lack of money probably should be thought of as a mental illness, because you literally can’t stop thinking about money.

Nothing new here.

What I’ve found is something different. The anxiety you get while trying to build personal wealth is healthy. It’s free motivation and gives you urgency.

I’m worried that if one day I’m wealthy enough, I will no longer have my daily anxiety. It’s a compass that has done a lot of good in my life.

It’s pushed me to break paradigms and go harder than if I didn’t have it and was chill about the world and business.

Stop trying to get wealthy to end anxiety. Anxiety is healthy.

Bad Habit #9 — Get multiple streams of income

Wait, what?

Yep, I preach multiple streams of income. But I’ve been challenged by Matt Paulson. He’s a money cowboy from the motherland.

He says the multiple streams of income thinking gets you from $100k-$200k. But if you want to hit the 7 figure range you gotta be smarter.

Be the absolute best at one thing” is better advice if you want to make $1M+ a year.

A lot of wealth just comes down to how you think. And the bigger you can think, the wealthier you can get with no extra effort. It’s the same with the “invest in index funds advice.”

It sounds smart but you’ll be making pennies for decades and then become too old to enjoy the cash and still have orga$ms. Worth rethinking this cliche money advice.

Bad Habit #10 — Relying on someone else for your success

My mother is going to kill me if she reads this one.

“Timothy, get your ass home right now for a beating. How dare you!”

Soz momma. I realize this one blows up the view of the world that the boomers worship. It is what it is.

Relying on an employer for your welfare and a gold watch at your age 65 retirement party is dangerous.

The structure of the economy has shifted. Having people on the payroll for the sake of it doesn’t make sense anymore. Just-in-time services and humans are now possible, thanks to high-speed internet.

The biggest threat to your success is being laid off or stuck in a recession without a job along with millions of others. A job gets you paid less than you’re worth because the nature of capitalism is an employer has to profit from your time more than you do.

Doesn’t mean jobs are bad. Just means there are two options:

- A job with a side hustle and multiple streams of income

- Start a business

Most people should probably take option one. But those who just have jobs and nothing else are standing on hidden landmines.

Own your time, work, and income — or die trying.

Bad Habit #11 — Not calculating the future cost of your decisions

The best math you can learn is how to calculate the future costs of your current decisions — Steven Bartlett

Indecision is a common virus that robs people blind and leaves them naked in the street exposed to the cold.

It’s easy to put off big decisions, especially if they have fear attached — changing jobs, starting a business, investing in your self-education, buying financial assets. But the cost of not deciding is huge.

If you make the hard decision today, assuming it’s a financially smart one, you give yourself more time for the investment to compound. Because most good money things don’t happen overnight.

So trade calculating the discount on hamburgers (if you pay with rewards points) for calculating the cost of your big decisions.

Final Bad Habit

To become wealthy you need a healthy level of motivation.

A bad habit I see is people don’t know why the hell they’re waking up in the morning. They don’t know why they want to be wealthy. Don’t worry, that was me too. Not anymore.

The easiest way to stay motivated to become wealthy is to focus on someone you care about. For me, it’s my 11 month old daughter. Whenever I can’t be assed making money, I think of her.

I think of her college education, the countries she’ll want to travel to, the shoes she’ll wear, the birthday parties we will have for her … then my motivation becomes laser-focused.

My wealth goal is to *not* let her down.

My financial success determines how abundant her life will be (at least until adulthood), so I have a duty to do the best I can for her.

When I think about this reality it makes me emotional. There’s nothing I wouldn’t do for her.

Find your why. Double down. Go all in on it.